Retailers Battle a Consumer Returns Fraud Conundrum

Recent Radial research highlighted key retailer and consumer returns trends, and one trend in particular caught our attention. We call it the consumer returns fraud conundrum. In short, retailers struggle with returns fraud, while shoppers may not-so-quietly be interested in redefining returns fraud and abuse for their own benefit. Let’s learn more about returns fraud, and what it could mean for modern brands leading into 2026.

The end of 2025 looms large for many brands, and most retailers are focused on ending the year strong via a successfully executed holiday peak season. But the new year signals another type of peak—peak returns. How retailers prepare for and manage returns likewise affects their customers, and their bottom lines. That means now is the perfect opportunity to reassess returns management operations and processes.

Recent Radial research highlighted key retailer and consumer returns trends, and one trend in particular caught our attention. We call it the consumer returns fraud conundrum. In short, retailers struggle with returns fraud, while shoppers may not-so-quietly be interested in redefining returns fraud and abuse for their own benefit. Let’s learn more about returns fraud, and what it could mean for modern brands leading into 2026.

Peak Season Pressures Returns Processes

The data is clear: The holidays, including an action-packed Black Friday / Cyber Monday week, drive a surge in retail sales. For many retailers, this peak season is key to a successful year, and they must operate both efficiently and effectively throughout the holiday period to win and keep their customers. But then the returns start pouring in.

The surge of returns during and after the holiday season pressures retailers’ operational processes. They must strike a balance between managing already strained operations and meeting customers’ lofty expectations.

For many retailers, the peak returns season is further complicated by a spike in returns fraud and abuse. Cases of fraud and abuse have spiked in recent years, and they cause significant pain for brands already navigating their busiest season.

Returns Fraud and Abuse Creates a Conundrum for Retailers

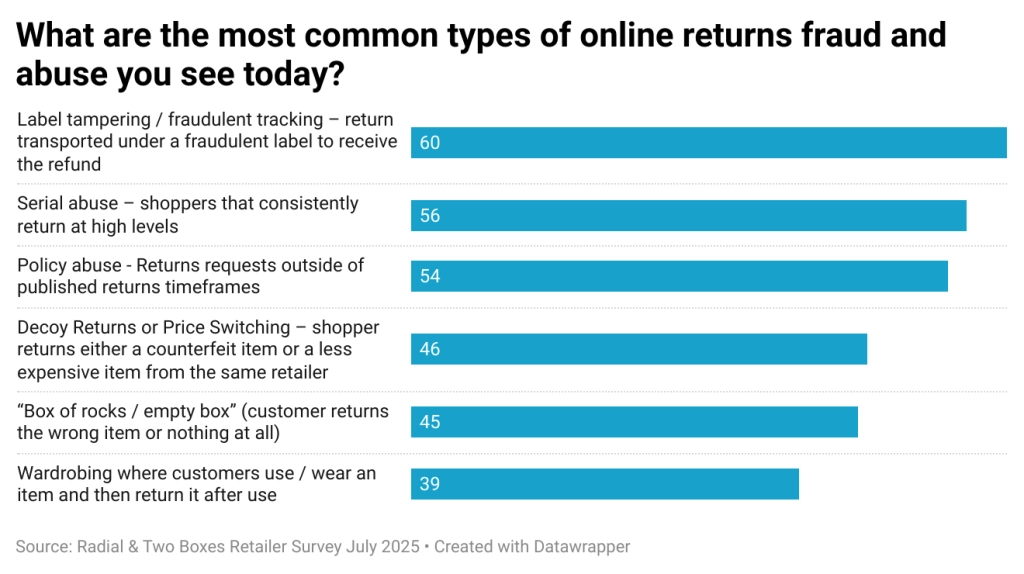

Per a recent Radial and Two Boxes retailer survey, 44% of brands claim that the biggest returns pain point they face is returns fraud and abuse. Fraud methods grow more complex year over year, with retailers describing label tampering and fraudulent tracking as the top causes of fraud. Fraudsters may be growing more sophisticated, discarding simpler decoy and empty box returns for more complex tactics.

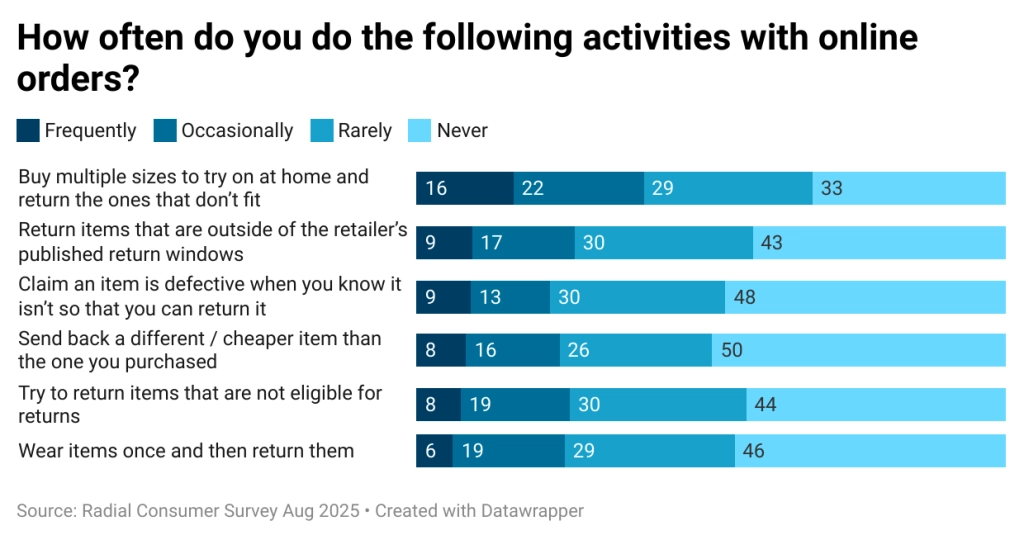

Importantly, Radial’s research indicates a disconnect between how retailers and consumers view returns fraud and abuse. Shoppers find certain types of fraud acceptable, even normal, while retailers feel the pain of fraudulent returns.

Consumers View Fraud and Abuse Differently than Retailers

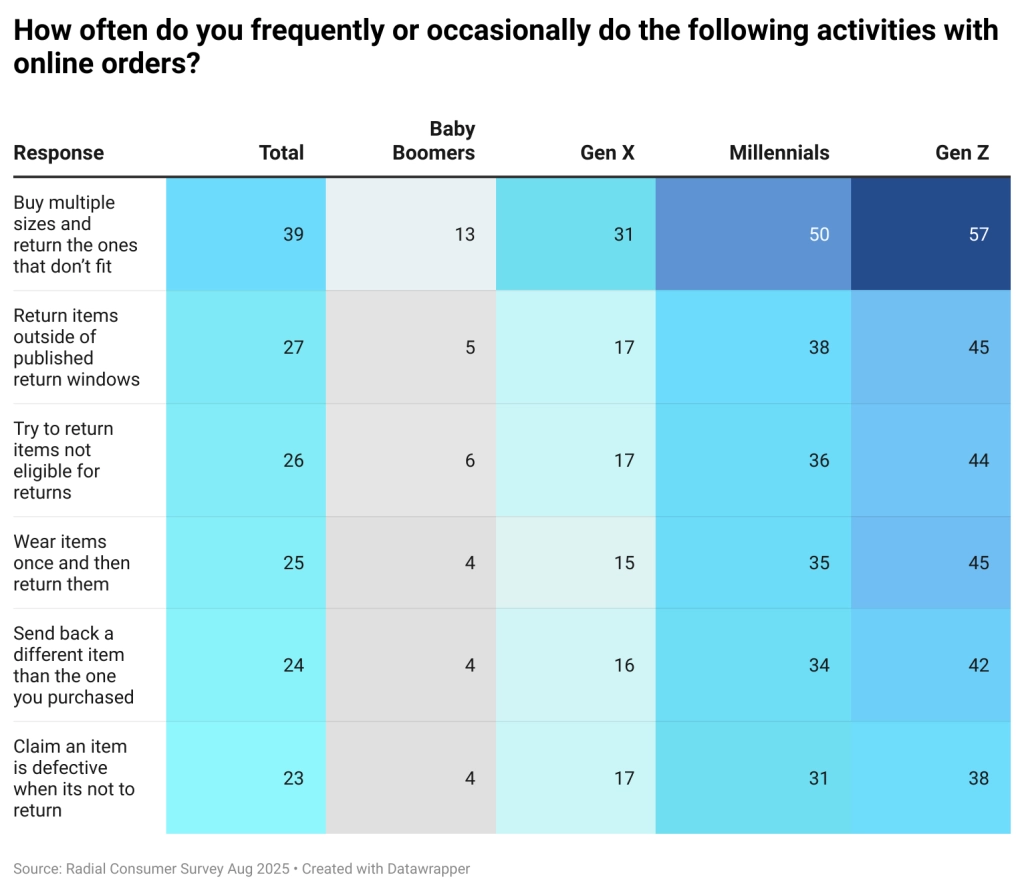

There are fundamental differences in how consumers define returns fraud and abuse. One big example: Consumers are generally more open to “friendly fraud”, like bracketing (purchasing multiple items in different styles and colors with the intent to return them) and returning items outside retailers’ published return windows. This is particularly true for younger shoppers, where for instance, 57% percent of Gen Z and 50% of Millennials frequently or occasionally bracket.

Friendly Fraud and First-Time Buyers

Friendly fraud is not always a bad thing. Kyle Bertin, Co-Founder and CEO of Two Boxes, noted in a recent Radial / Two Boxes webinar that retailers may actually benefit from allowing bracketing for first-time buyers or buyers shopping in new categories. After all, these shoppers need to understand how a new brand or SKU looks and feels. This is especially true for apparel brands, where new customers may need to try out a style or fit to confirm it works for them. Bertin notes that, in this case, brands would be wise to allow a certain level of bracketing to occur initially. It builds trust and allows the customer to find the product that works best for them.

Younger Shoppers Perpetuate Other Forms of Malicious Fraud

Importantly, when we look at the demographic data, younger shoppers tend to expand their focus beyond “friendly fraud” and into other categories of more malicious fraud. Millennials and Gen Z are more likely to return items that are not eligible for returns. And while the rates are lower compared to friendly fraud like bracketing, younger generations are more likely than older shoppers to send back different items than the ones they purchased and to claim items are defective. Forty-two percent of Gen Z shoppers at least occasionally switch items, compared to only 4% of Baby Boomers.

In order to navigate the growing population of younger shoppers open to at least some types of returns fraud, retailers will need to carefully examine and improve their fraud detection processes.

Modern Brands Balance Customer Experience to Reward Great Customers and Identify Bad Actors

What does this mean for retailers facing both higher return volumes and higher fraud and abuse incidents? They will need to leverage strategies designed to balance great customer experiences for loyal shoppers while identifying bad actors. That means improving fraud detection and prevention. Brands can enhance fraud detection and prevention processes by:

- Assessing return windows for different buyer profiles (e.g., first time purchases versus chronic returns)

- Requiring photographic evidence of defective products

- Monitoring customers with higher-than-average return rates

- Inspecting products before providing customers with refunds

- Leveraging dynamic policies to reward loyal customers with easier returns, while flagging higher risk accounts

Additionally, modern brands will need to reassess customer support strategies designed to manage and mitigate return frustrations. That means reviewing communication processes to clearly explain return policies from the beginning of the order process. This helps craft the return experience and manage customers’ expectations throughout.

Returns Partners Can Relieve Retailer Pain

Returns management isn’t easy. Retailers shouldn’t be stuck managing it alone.

Ultimately, many retailers may need to seek experienced partners and technology integrations to more effectively evolve their returns processes. Partnerships with trusted third parties means catching bad actors faster, as well as rewarding great customers with the experiences they deserve. That means reduced returns costs and happier customers in the long term, all while allowing brands to focus on what they do best: creating and selling great products.

Learn more about scalable, cost-effective fulfillment.