Top Retailer Returns Challenges in 2026

Retailers face a new challenge in 2026: peak returns. High shopping activity around the holidays means increased returns—and modern brands will need to navigate high customer expectations while simultaneously optimizing the value of returned inventory.

The 2025 holiday season—full of value-driven consumers and a surge in AI shopping—is receding as we kick off 2026. Retailers now face a new challenge: peak returns. High shopping activity around the holidays means increased returns—and modern brands will need to navigate high customer expectations while simultaneously optimizing the value of returned inventory. Additionally, with consumers most focused on value in 2025, there may be a spike in returns as some shoppers prioritize pocketbooks over presents.

Let’s review key trends discovered via Radial research to identify the top returns challenges retailers will face in the new year.

Shoppers Consider Tradeoffs for Returns

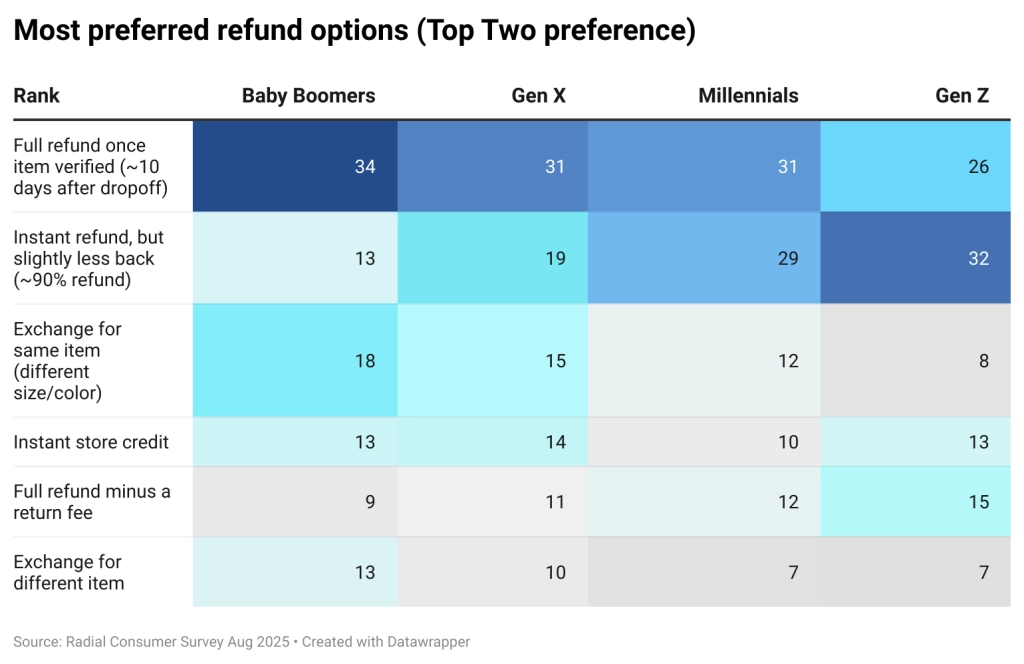

Brands already have a tough balance to strike when it comes to preferred refund options. Consumers expect the ideal return experience by default, but they are willing to make tradeoffs in reality. For example, 30% of consumers are willing to wait a little longer for a full refund, while 23% accept an instant refund with slightly less money back. This trend shifts by generation, however. Baby Boomers are most likely to wait for a full refund and are the least likely to seek an instant refund with slightly less money back. Younger shoppers, especially Gen Z, are more open to instant refunds. Additionally, Gen Z is the most likely to accept a full refund minus a return fee, albeit at only 15%.

The least popular refund option overall was an exchange for a different item. Only 9% of shoppers are open to exchanges as a top option. This means that most returns are not made due to a sizing, fit, or usage issue, where shoppers like a product but need a better “fit”. By not accepting an exchange, shoppers are signaling they are not satisfied with the product they purchased. This is important for retailers to consider, since the rise of eCommerce shopping has led shoppers to make blind purchases regularly.

Amid High Returns, Retailers Seek to Maximize Value via Strategic Dispositioning

Radial’s data indicates that brands focus most often on maximizing value and reducing potential losses when developing their returns processes. That means optimizing the entire returns process while strategically developing dispositioning options for returned inventory:

- Most brands (59%) resell between 11% and 50% of their returns through existing channels to maximize their return-to-stock opportunities.

- Some retailers turn to third-party resellers, with over a third liquidating 11-25% of their returns and 15% liquidating up to 50%.

- Brands also seek to drive returns value through manufacturer credits, as well as outlet and clearance options.

Ultimately, retailers seek disposition options that reduce the need to destroy, donate, or recycle products. These strategies help recoup some value, but many brands may still need to improve grading, restocking, and future commerce options to maximize the value of returned inventory.

Fraud and Abuse Ranks as the Top Retailer Returns Pain Point

Brands face many returns challenges, but Radial’s survey data reveals that 44% of retailers claim managing returns fraud and abuse as the biggest pain point they face in the new year.

There’s a dual challenge here. First, consumers fundamentally view returns fraud differently from retailers—and this may accelerate as consumers seek to maximize value out of their returns. Additionally, shoppers are further complicating life for retailers by embracing more complex forms of returns fraud. Retailers describe label tampering and fraudulent tracking as the top issue, followed by serial abuse and policy abuse. This may indicate that fraudsters are growing more sophisticated as simpler decoy and empty box returns fall further down the list.

Shoppers Fundamentally View Returns Fraud Differently from Retailers

Shoppers don’t label certain behaviors as fraudulent—and it creates new challenges for retailers. For instance, many consumers are comfortable with “friendly fraud”, like bracketing and returning items outside valid return windows. This is especially true for young shoppers. Fifty-seven percent of Gen Z and 50% of Millennials frequently or occasionally bracket.

In fact, younger shoppers tend to expand their focus beyond more forgivable friendly fraud and into other, more malicious categories. For example, Millennials and Gen Z are more likely to return items that are not eligible for returns. And younger generations are more likely than older shoppers to send back different items than the ones they purchased, as well as to claim items are defective. Forty-two percent of Gen Z shoppers at least occasionally switch items, compared to only 4% of Baby Boomers.

For retailers, this means developing new ways to navigate younger shoppers’ behaviors while working to improve fraud detection processes across the board. They will need to leverage strategies designed to balance great customer experiences for loyal shoppers—all while identifying bad actors.

In-House Returns Processes May Limit Brands in 2026

Another trend Radial identified: Many brands face returns challenges without support. Nearly half (48%) of retailers currently manage returns in-house. And while brands often work with external partners as they grow, some brands opt to manage returns in-house, even at scale.

In-house returns management can create significant operational headaches as brands grow and scale. It requires dedicated labor, processes, and technology considerations to manage efficiently and effectively—all while mitigating potential fraud and navigating customer service requirements.

Some brands no longer intend to navigate returns challenges alone. Over one-third of brands managing returns internally would consider outsourcing to a 3PL.

Modern Brands Seek Partners to Optimize Returns

So what do brands look for in a 3PL partner to succeed amid peak returns?

For those that choose to work with 3PLs, 59% do so to reduce returns costs. Over 56% of retailers seek partners to support fraud prevention, improve returns accuracy, and improve the consumer return experience with more pick-up and drop-off options.

Brands turn to logistics experts to support operations to drive revenue and customer retention. But selecting the right partner is critical. In fact, 28% of brands will likely stop working with a 3PL over poor returns operations. This signals the need for 3PLs to ensure returns processing capabilities are optimized.

Select the Right Partners to Drive Returns Success in 2026

Retailers will always need to manage returns, but they don’t have to be painful. 3PL partners are uniquely positioned to help brands across industries solve the biggest returns pain points. Retailers benefit from the combination of highly experienced operators working with leading technologies to reduce costs and tailor return policies to benefit loyal customers while disincentivizing fraudulent bad actors. Partnerships with trusted third parties means rewarding great customers with the experiences they deserve. And that leads to reduced returns costs and happier customers in the long term, all while allowing brands to focus on what they do best in the new year: creating great products.

Learn more about scalable, cost-effective fulfillment.