The Latest Consumer Return Trends with Peak Returns Around the Corner

Dive into the latest Radial consumer research and review key trends that modern brands need to know ahead of peak returns season.

Peak season is on the horizon, and retailers have their hands full managing shoppers’ high expectations ahead of the holidays. Shoppers plan to make their holiday purchases early and intend to take advantage of seasonal promotions and deals. For many retailers, it will be crucial to optimize their fulfillment in the rapidly closing window before the holidays. Radial’s research shows that operational consistency is critical to build brand trust and long-term customer loyalty.

The months immediately after the holidays are no less busy for modern brands, however. In fact, retailers often face a second peak season: peak returns. And how retailers set up and manage returns likewise affects customer loyalty.

Let’s dive into the latest Radial consumer research and review key trends that modern brands need to know ahead of peak returns season.

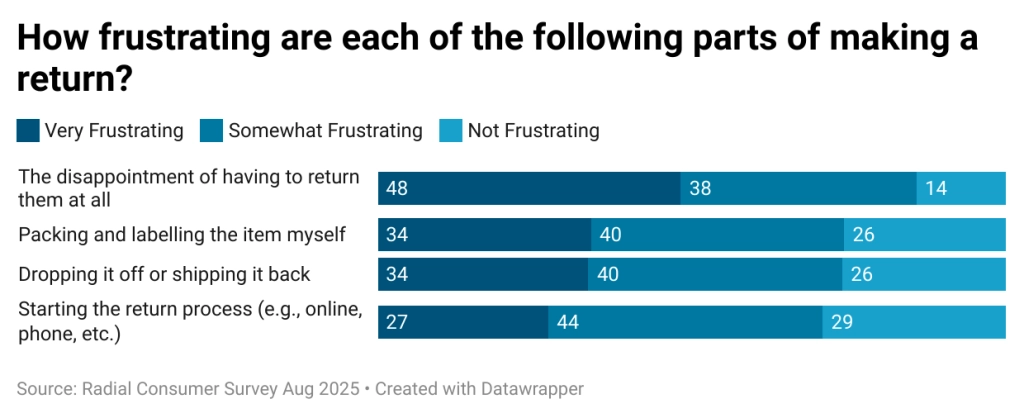

Consumers Find Returns Frustrating

The results are in: Consumers do not like making returns. For nearly half of consumers, the most frustrating element of returns is the fact that they have to return the product at all. It’s disappointing when you don’t get the product you want, and as that frustration can build with the additional steps required to make a return, it’s clear to see why returns are a sore spot for consumers.

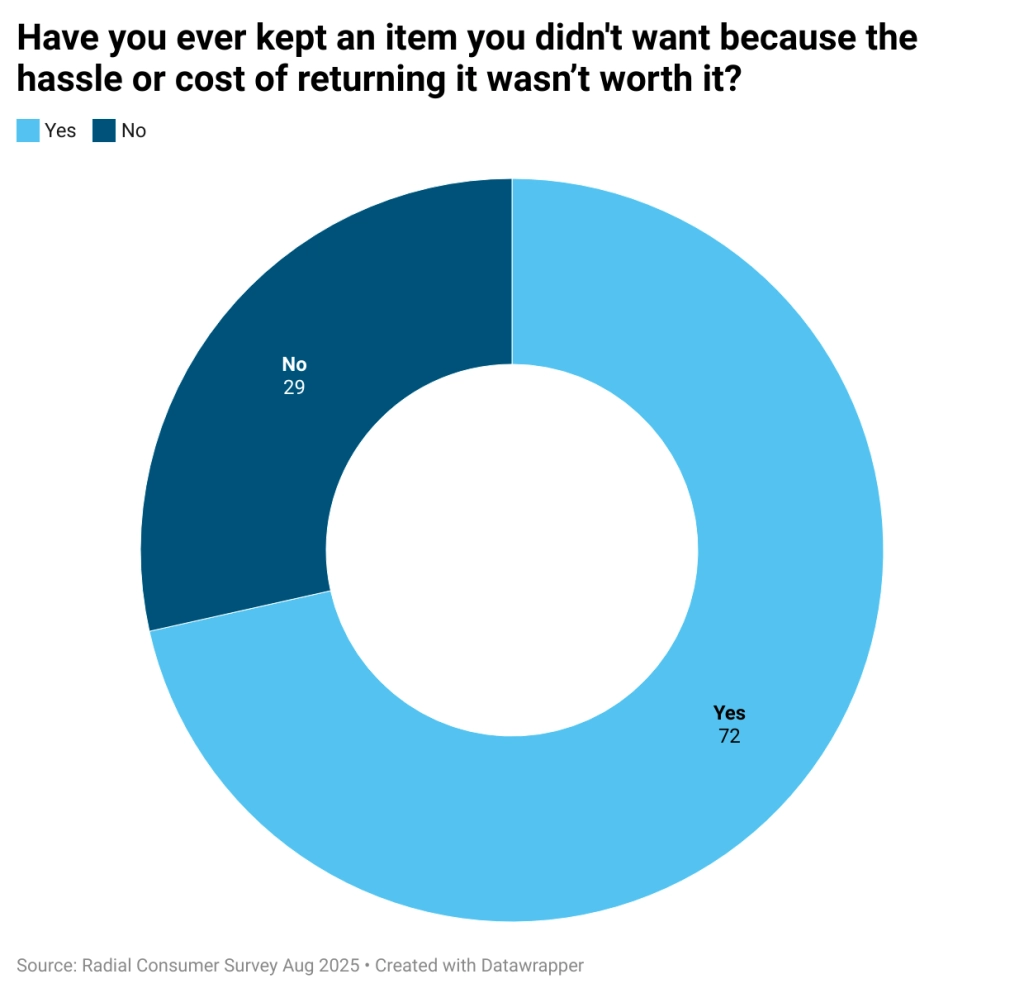

In fact, returns can be so frustrating that many will simply keep products they don’t want—and won’t be purchasing again—rather than deal with returns processes.

This creates an uphill battle for retailers, who bear the burden and costs of the actual return. They already face a deficit in customer satisfaction and still need to balance customer frustrations with policies and processes to accelerate product disposition (the best use of the returned product) and minimize costs.

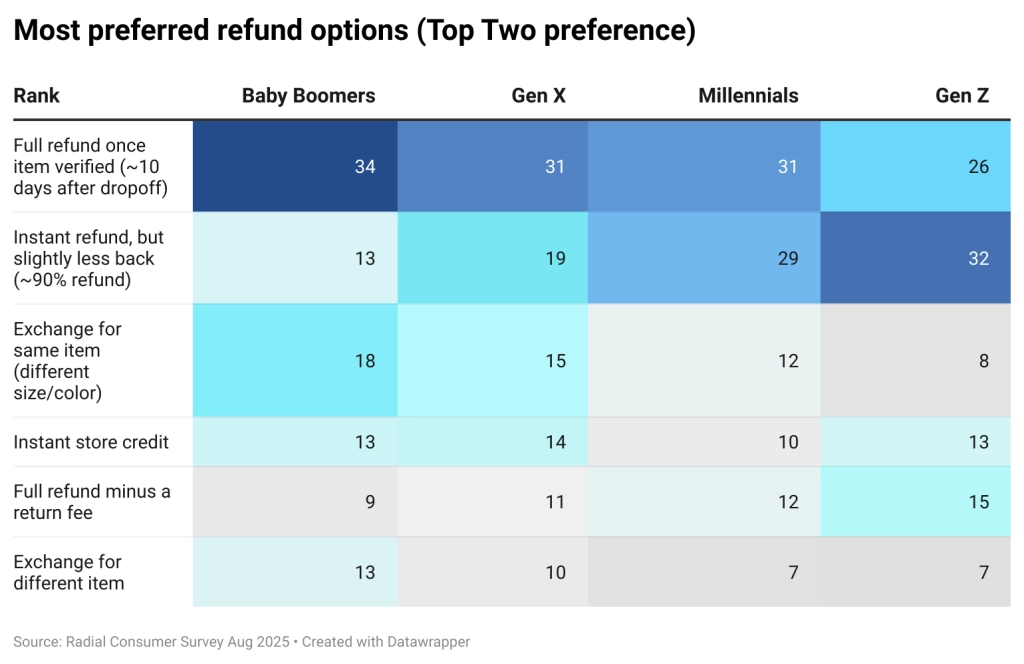

Retailers Balance Tradeoffs Over Refunds

Retailers have a tricky balance to achieve when it comes to preferred refund options. Consumers expect the ideal return experience by default, but they are willing to make tradeoffs in reality. For example, 30% of consumers are willing to wait a little longer for a full refund, while 23% accept an instant refund with slightly less money back. This trend shifts by generation, however. Baby Boomers are most likely to wait for a full refund and are the least likely to seek an instant refund with slightly less money back. Younger shoppers, especially Gen Z, are more open to instant refunds. Additionally, Gen Z is the most likely to accept a full refund minus a return fee, albeit at only 15%.

The least popular refund option overall was an exchange for a different item. Only 9% of shoppers are open to exchanges as a top option. This indicates that the majority of returns are not due to a sizing, fit, or usage issue, in which case shoppers like a product but need a better “fit”. By not accepting an exchange, shoppers are signaling they are not satisfied with the product they purchased. This is important for retailers to consider, since the rise of eCommerce shopping has led shoppers to make blind purchases regularly.

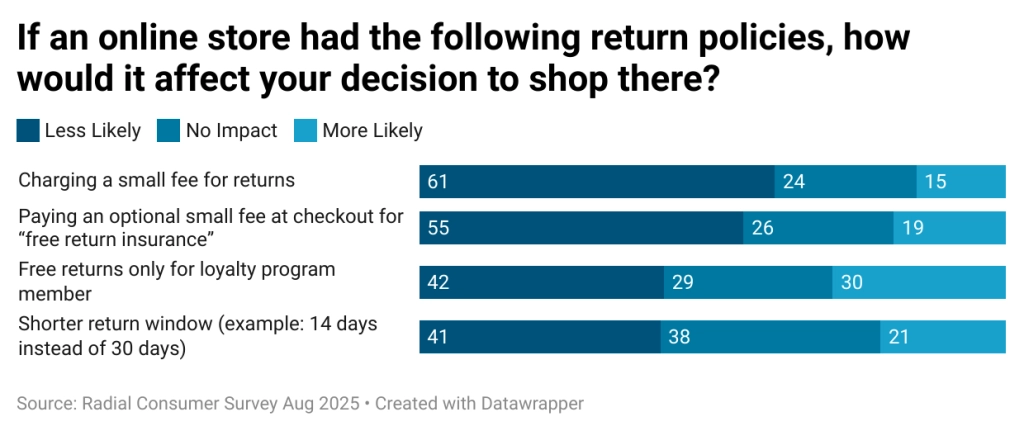

Shoppers Do Not Want to Pay Return Fees

Shoppers want refunds, and they do not want to pay for returns. Sixty-one percent of consumers say paying return fees will make them less interested in shopping with brands again. They are open to other return policies, like shorter return windows or even free returns for loyalty members only; they are not interested in paying anything additional when making a return.

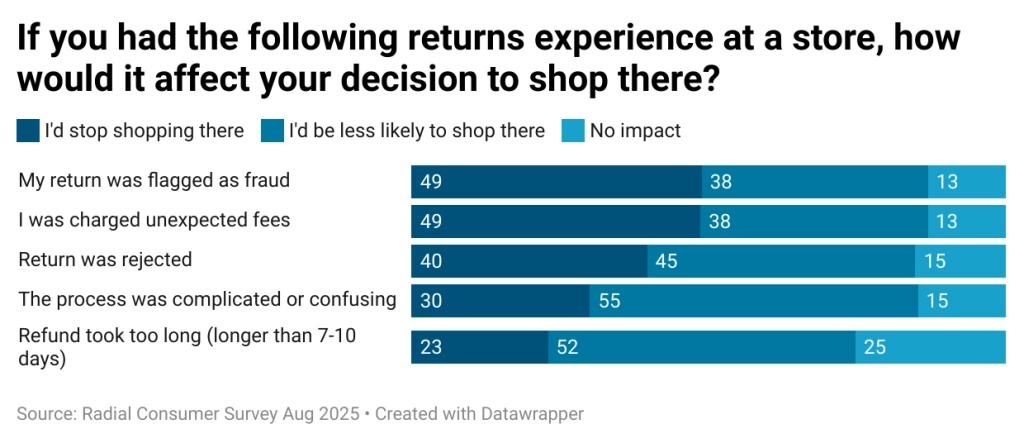

Consumers also respond negatively to false fraud allegations and unexpected fees. Forty-nine percent of shoppers will stop shopping with a retailer that flagged a return as fraudulent. An equal amount will stop shopping if they are charged surprise fees.

Consumers Have a Different View of Fraud Than Retailers

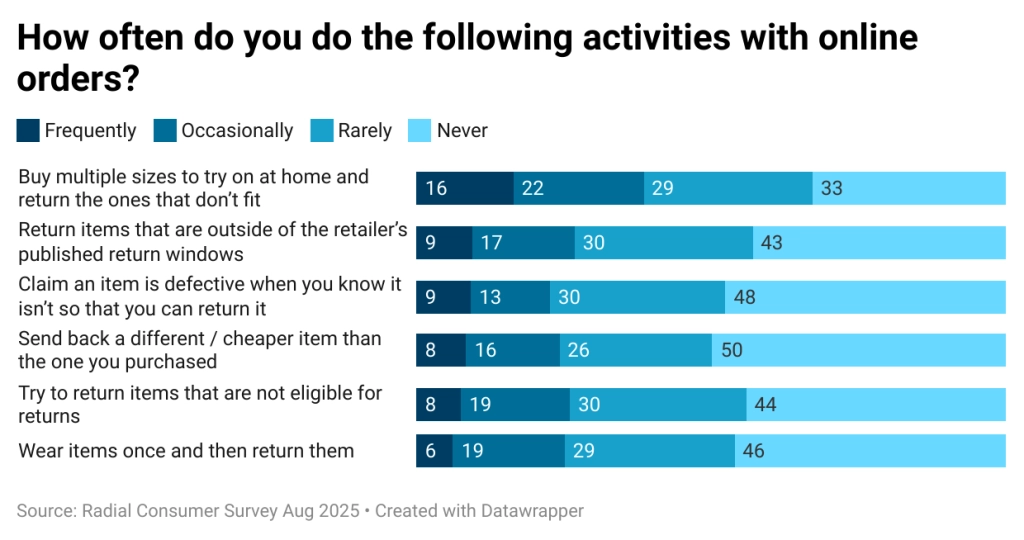

Per a recent Radial and Two Boxes retailer survey, 44% of brands claim that the biggest returns pain point they face is returns fraud and abuse. But there are fundamental differences between how retailers and consumers define fraud in the first place. For example, consumers generally do not consider bracketing (purchasing multiple items in different styles and colors with the intent to return items) to be fraud. This is especially true for younger generations. Roughly one-third of Gen Z shoppers frequently bracket.

Likewise, wardrobing (purchasing an item to wear or use then returning it) is considered somewhat acceptable, especially for younger consumers. The overarching trend from Radial’s research indicates that fraud definitions are most flexible for Gen Z. Approximately 40% of surveyed Gen Z shoppers participated in each of the listed fraud types on occasion.

This creates real challenges for retailers, especially those catering to younger shoppers. They will need to assess returns processing to identify more complex fraud early. They may also need to consider customizable return policies designed to benefit loyal customers while weeding out bad actors. These policies will need to be backed by proven returns technology and operational expertise.

Retailers Balance Customer Experience and Optimized Returns

How do modern brands navigate high customer expectations, as well as their shifting definitions of fraud, all while managing operational costs?

Retailers will always need to assess and optimize how they manage returns, but that doesn’t mean returns have to be painful. They can develop in-house resources, or work with third-party partners, to solve the biggest return pain points and still satisfy customers. They can leverage proven processes and technology enhancements to accurately detect and mitigate returns fraud, as well as reducing returns costs. They can also improve processing time to enhance inventory health. Ultimately, they can develop convenient return programs that protect their costs and peace of mind during peak demand periods and beyond.

Learn more about fast, cost-effective fulfillment.