Here’s What Anxious Consumers Expect from Brands This Peak Season

For many brands, Q3 and Q4 of 2025 will center on preparing for and navigating peak holiday shopping. To equip these brands, Radial dove into key consumer data to determine what’s connecting with shoppers ahead of the holidays—and how retailers can drive a successful peak season.

The drum beat of economic uncertainty has consumed brands and shoppers alike throughout 2025. Experts use the word “uncertainty” so repeatedly that it may have lost its meaning for the average person.

Nevertheless, uncertainty is the best word to use for the pendulum swing of anxiety experienced by both business leaders and shoppers amid tariff changes, economic turbulence, and geopolitical tensions.

- The toy industry describes a challenging outlook ahead of the holidays. Nearly 60% of toymakers executed layoffs in July and August.

- Fast casual restaurants experienced a customer slowdown in Q3 and described cautious diners as experiencing an “economic fog”.

- A wide variety of brands across industries are adjusting to the new normal of tariffs by assessing price increases and reprioritizing sourcing strategies.

- In contrast, US online spending surged in July, driven by Amazon Prime Day, back-to-school shopping, and other related promotions and sales. Consumers capitalized on early deals and spent their dollars strategically.

For many brands, Q3 and Q4 of 2025 will center on preparing for and navigating peak holiday shopping. To equip these brands, Radial dove into key consumer data to determine what’s connecting with shoppers ahead of the holidays—and how retailers can drive a successful peak season.

Anxious Consumers Spend Carefully Ahead of Peak

While consumer sentiment improved as potential tariff threats and corresponding economic anxiety eased in July, new tariff announcements and increasing inflation may cause them to shop with renewed caution. Per a May 2025 Radial tariff survey, 95% of consumers are aware of tariff increases, and 74% say they’ve already changed or plan to change how they shop. Only a quarter expect no change at all. As tariffs begin affecting prices, as well as changes in tax exemptions like de minimis, consumers may be more cautious leading into the holidays.

Likewise, Radial found that shoppers are price sensitive and shift priorities to plan seasonally and stockpile when necessary. They focus first on necessities. Thirty percent of consumers plan to spend less on discretionary items to ensure they have money for what they need. And 21% plan to buy fewer products overall.

Consumers Crave Trustworthy Brands

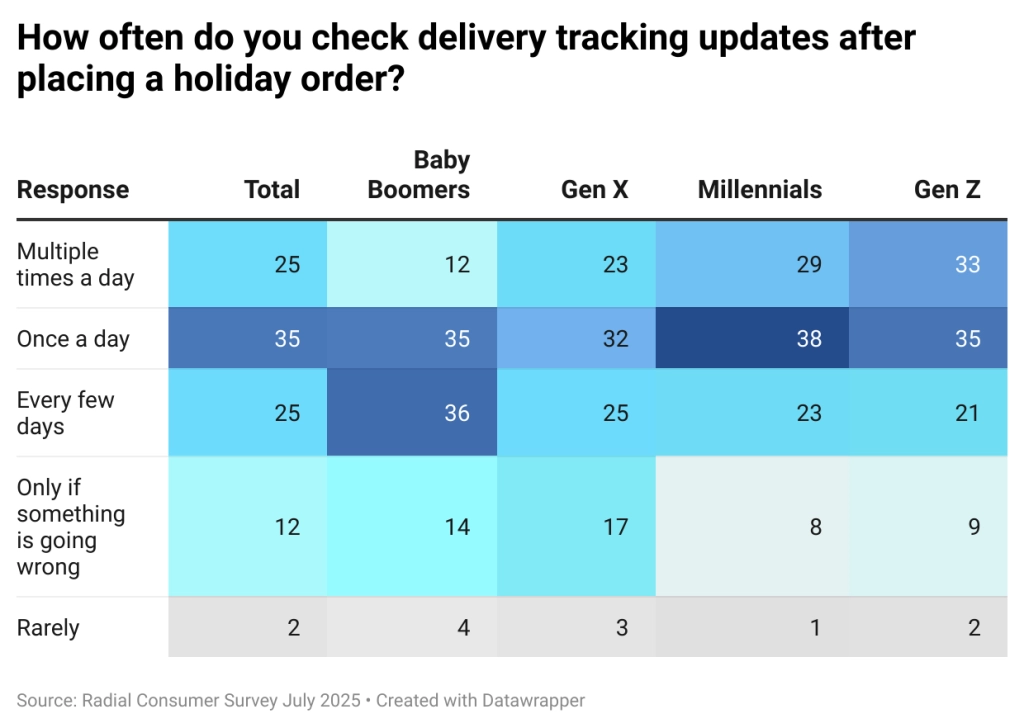

But there are other signs of anxiety beyond shifting spending priorities. A third of shoppers check their delivery updates at least once per day, with a quarter checking multiple times per day. Obsessive tracking increases for younger generations, with 33% of Gen Z checking more than once daily, followed by 29% of Millennials. With the wider world feeling uncertain, perhaps online shoppers are double-checking to make sure their recent purchases at least arrive when promised.

That’s not all: Ultimately, consumers want to shop with brands they can trust offering quality products and great customer experiences.

Shoppers Seek Certainty and Precision from Brands and Retailers

Shoppers prioritize trust in 2025. Value is always a consideration, and price is a common factor listed by consumers across the board. But Radial’s research also indicates that product and fulfillment quality and reliability are key components. As already described, shoppers are constantly checking that their brands are delivering on time and in a trustworthy manner. If brands break their promises, shoppers notice and move on to competitors.

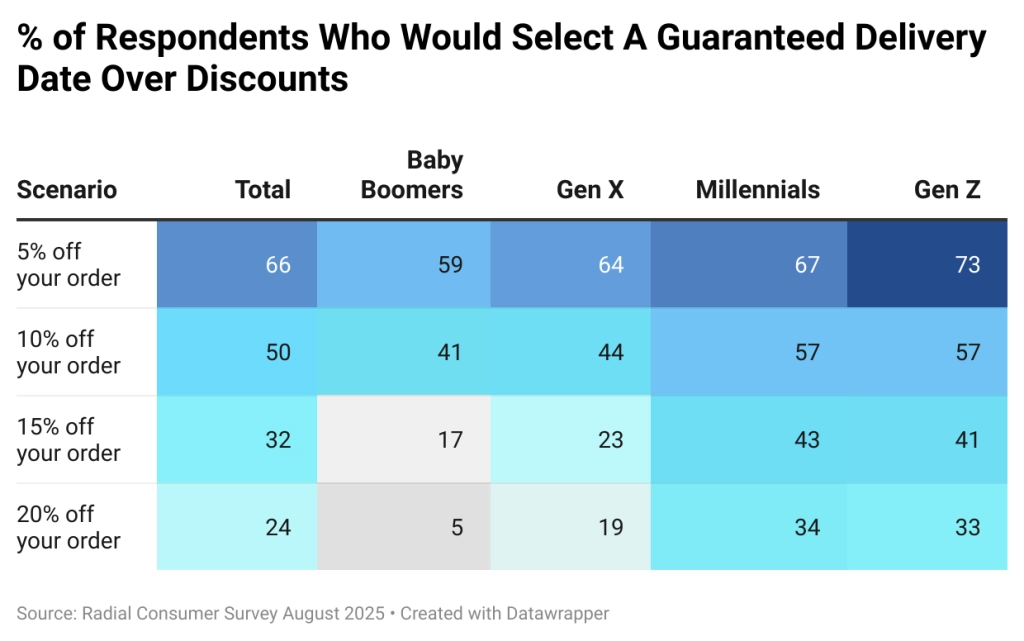

Shoppers are so focused on certainty in 2025, they are willing to sacrifice potential discounts for delivery precision. Sixty-six percent of consumers are willing to give up a 5% discount to guarantee their delivery window. Even when the discount climbed to 20%, nearly one in three younger shoppers still prioritize delivery certainty over savings.

There has been a lot of talk in eCommerce about the value of tighter delivery timeframes and expected delivery dates. These data indicate that consumers crave more certainty in delivery timelines and are willing to make tradeoffs to get it.

Customers Want to be Rewarded for Loyalty

Once shoppers place their trust in a brand, they want to be rewarded for their loyalty. Consumers listed loyalty incentives as the second most important factor for selecting a retailer when looking at buying an item online. And per Radial’s March 2025 consumer survey, shoppers listed loyalty programs as the third highest reason they consider purchasing more often from a brand.

Retailers are taking notice. Per EMARKETER, 67% of retailers currently offer a loyalty program, with another 29% planning to roll one out within the next two years. Brands can both build customer relationships and pursue nuanced offerings, such as birthday perks, better shipping options, and extended returns windows, increasing the overall quality of customer fulfillment experiences while reducing the odds of cart abandonment.

It will be important that brands refine their loyalty offerings to connect with younger generations. Gen Z and Millennials are the least brand loyal to date, and they frequently switch brands over price and poor fulfillment experiences.

Brands Can Build Trust with Anxious Consumers Over the Holidays

So what does this data mean for modern brands? It indicates that trust starts and ends, not with a web presence, eCommerce integration, or brand recognition, but with the overall quality of the shopping experience—from click to delivery.

We’ve observed this trend many times in 2025 across demographics, industries, and even international borders. Great shopping experiences, combined with quality fulfillment, win customers. With a holiday peak season defined by cautious, anxious consumers, brands cannot simply compete on price or promotional strategies. They will need to lean into great customer experiences backed by operational excellence.

Get started with fast, cost-effective fulfillment.