Modern Brands Win Customers by Focusing on Quality

Consumers want quality products delivered via quality eCommerce fulfillment. Modern brands need to respond fast and flexibly.

Consumers are anxious amid economic uncertainty. The University of Michigan’s consumer sentiment index dropped 8% month over month in April as shoppers worried about higher prices and tariff repercussions. Consumer expectations dipped 32% since January—the sharpest three-month decline since the 1990 recession.

And that anxiety may be warranted. Tariff uncertainty, combined with a US economic contraction in Q1 2025, has both consumers and business leaders concerned. Sixty-two percent of CEOs predicted a recession or slowdown in the next six months due to changes in tariff policies and the market and trade repercussions. Retailers boosted inventories ahead of tariff deadlines, and some consumers began creating stockpiles of their own.

In the medium and long-term, consumer anxiety may trigger shifts in spending as consumers grow more cautious. Anxious consumers will likely refocus on essential goods, potentially deprioritizing or reducing purchases in other categories.

Modern brands will need to assess what consumers want and need during this new period of uncertainty and respond flexibly—or risk losing business.

Consumers Want Two Kinds of Quality from Modern Brands

To win customers amid uncertainty, modern brands must first ask: What do consumers really want?

Per Radial’s research the answer is often centered on quality. For example, 32% of consumers say product quality is the top reason they choose to buy from a DTC brand, and 29% are motivated by access to unique products they can’t find anywhere else. Sixty-two percent of consumers say that declining product quality will cause them to lose trust in a brand. This mirrors similar trends Radial uncovered in the home furnishings and sporting goods industries. As tariffs drive price increases, consumers will likely refocus on higher quality products to maximize value long-term, buying fewer items that are built to last, rather than many products of lower quality. Even with rising tariff uncertainties and corresponding price increases, only 14% of consumers plan to buy cheaper substitutes versus name-brand products according to a May 2025 Radial consumer survey.

Changes to the De Minimis Exemption and Its Effect on Consumers

In conjunction with tariff changes, the Trump administration first ended the de minimis exemption for products from China and Hong Kong in April 2025. The de minimis exemption defined the minimum value threshold under which tariffs and import duties are waived. Before May 2025, the threshold for goods allowed packages under $800 in value to enter the US duty-free. Now all shipments with goods originating from China are assessed for tariffs, duties and taxes and require formal clearance.

De minimis helped companies like Temu or Shein maintain leaner US inventories and reduce shipping costs. They could ship inexpensive, relatively low-quality products direct to the US easily under the exemption, avoiding duty and tax. With changes made to de minimis, consumers will likely have to pay more to buy from these brands when they directly source from China, as tariff rates and import clearance fees will now be part of the equation. While these companies have sought to shift their US operating models to have more domestic US inventory or looked to move sourcing to less tariff-impacted countries, much of their products still comes direct from China. For many consumers, these brands remain attractive only when they are priced lower than higher quality competitors. Now, shoppers may switch to higher quality products as prices on lower quality goods increase.

Quality Fulfillment Drives Customer Loyalty

But it’s not only the quality of a product that drives consumers to connect with and return to a brand. They also expect a high-quality fulfillment experience.

From reliable shipping to order transparency to easy returns, Radial’s research shows that operational consistency, not just a great product, is essential to building brand trust and customer loyalty. Per a recent Radial survey, 72% of consumers say shipping speed and reliability are the most important factors in deciding whether to buy from a DTC brand. Product availability (66%) and easy/free returns (63%) rank even higher than values like brand identity or personalization.

Modern brands face a challenge, however. And it’s an internal one.

Modern Brands Face an Operational Crisis

Modern brands may design, source, and manufacture great products, but that’s only part of the equation for pleasing customers. They need to provide great fulfillment, too. But many brands are not equipped to both scale logistics operations and provide the experience customers expect.

Per Radial’s recent retailer survey, the majority of modern brands rely on in-house fulfillment solutions with either multiple (70%) or single (59%) facilities for at least some of their fulfillment needs. Only about 40% or less rely on outsourcing to manage some or all of their fulfillment needs.

In-house fulfillment works for emerging brands, but it creates challenges as brands grow and operations become more complex. It is resource intensive, needs capital to scale, and can distract brands from focusing on core competencies like operational strategy and product development. Worse, it also causes modern brands to lose customers when they can’t deliver the fulfillment experience consumers expect.

Growing Brands Face Transportation Challenges

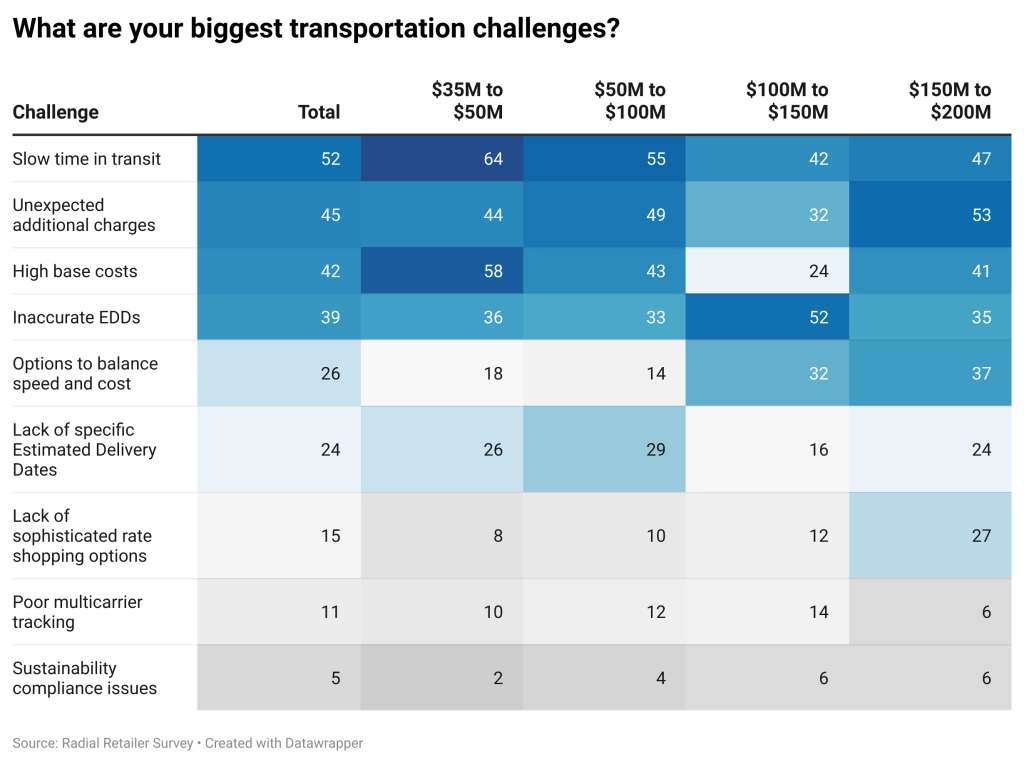

Transportation challenges lead to slower, unreliable deliveries and unhappy customers. Brands of all sizes face transportation challenges—but Radial research shows they face them in distinct ways.

Smaller brands more often struggle with slow time in transit. Lack of speed leads to unhappy customers. Shoppers expect fast shipping. Per Radial research, 29% of shoppers expect 2–3-day shipping, and 45% expect 3–5-day shipping. Over half of brands with revenues between $35M-$100M see slow transit times as the number one transportation issue. Slow transit times means that these brands are forced to either offer slower delivery options or run the risk of missing their delivery promises.

While unexpected additional charges affected 45% of all respondents, larger brands feel it most acutely at 53%. Larger retailers also struggle to balance speed and cost (37%), and they are often missing sophisticated rate shopping options (27%). These challenges may occur in part because these larger brands work with multiple carriers—something that is both resource intensive and complex.

Brands Lose Customers Due to Poor Fulfillment

Younger shoppers are the most likely to ditch a brand over poor fulfillment. Gen Z (35%) and Millennials (33%) report the highest frustration with delays and lack of communication, reflecting expectations shaped by Amazon-era convenience. Boomers, on the other hand, are more sensitive to price-related friction, with 33% abandoning carts due to high shipping costs.

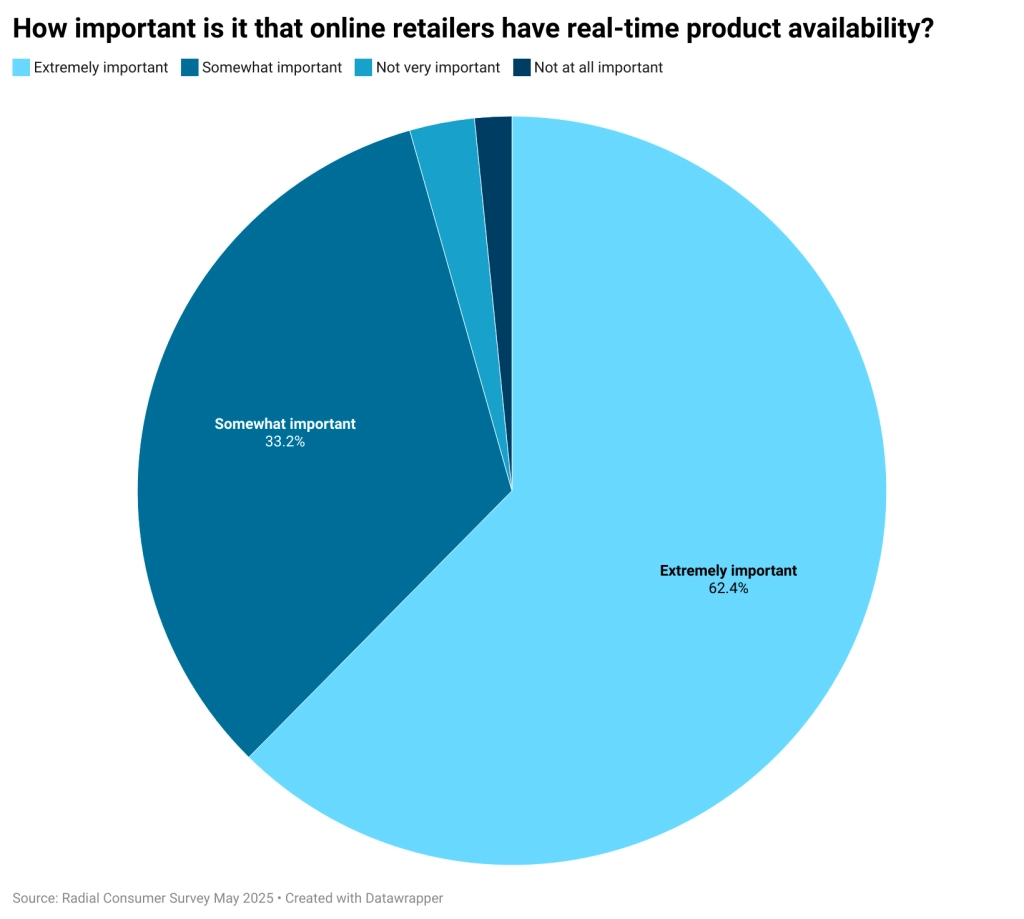

According to Radial’s May 2025 consumer survey, shoppers expect real-time product availability—especially with potential tariff-driven stockouts. Ninety-six percent of consumers rate real-time product availability as being extremely or somewhat important. Concerningly, many growing brands don’t have the operational expertise or technology solutions necessary for transparent real-time inventory management. And with slowing import volumes through April and May, consumers are more likely to face stockouts as retailers deal with inventory challenges.

For DTC brands seeking to grow and scale, poor fulfillment can be a dealbreaker. Nearly 40% of consumers quit buying from a DTC brand they liked because the retailer couldn’t keep up with demand. Delayed or canceled orders (29%), unexpected shipping costs (30%), and difficult returns (24%) create a customer experience that contradicts the polished image many of these brands present.

Modern Brands Can Solve Fulfillment Quality Issues

Radial’s findings show that nearly half of decision-makers (47%) struggle to scale fulfillment using their existing operations. They need configurable, cost-effective, and tech-enabled solutions. And they need the operational expertise obtained over years of successful supply chain management. These capabilities are especially critical when brands expand across channels while attempting to meet the rigorous demands of consumers.

Brands can still solve their fulfillment challenges and exceed customer expectations by expanding their logistics portfolio and investing in partnerships. They can create a partnership ecosystem tailormade to support their entire supply chain and industry-specific needs. Brands can also assess partners to find the right balance of technology, scalability, and operational expertise necessary to solve their specific fulfillment challenges.

Navigate Uncertainty with Radial Fast Track

Modern brands can face today’s challenges and differentiate themselves by focusing on both quality products and quality fulfillment. And they don’t need to do it alone.

Radial has the solution: Radial Fast Track. Radial Fast Track provides scalable, cost-effective fulfillment for modern brands, without upfront costs or long-term contracts. All backed by Radial’s simplified operating model, cutting-edge technology, and 40+ years of logistics expertise.

Radial Fast Track can help solve a variety of challenges:

- Expand your brand, grow, and scale: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly.

- Transition from in-house fulfillment to outsourced fulfillment: Onboard fast, with the ability to integrate in as little as a week—minimal resources required. We streamline fulfillment so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Navigate transportation and returns challenges easily: Get faster, cost-effective shipping no matter the size of the organization. Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost—and we handle returns for you.

Get started with fast, scalable, cost-effective fulfillment.