Tariff Threats and Economic Pressure Rewire Retail Behavior

US tariff policy has been making front page news, and it is rewiring retailer behaviors. Consumers are already making changes.

April and May saw business leaders and shoppers alike worrying about one thing: tariffs. US tariff policy made front page news over the past two months, driving up anxiety over an uncertain economic outlook. Tariff uncertainty, combined with a US economic contraction in Q1 2025, has both consumers and business leaders concerned. Sixty-two percent of CEOs predicted a recession or slowdown in the next six months due to changes in tariff policies and the market and trade repercussions. Retailers boosted inventories ahead of tariff deadlines, and some consumers began creating stockpiles of their own.

While US tariff policies and outlooks continue to evolve into June, both the current and potential future policy changes affect consumers’ behavior. Consumers aren’t waiting for prices to rise—they’re already adjusting. According to a recent Radial tariff survey, 95% of consumers are aware of the tariff increases, and 74% say they’ve already changed or plan to change how they shop. Only a quarter expect no change at all. Tariff changes and delays don’t leave consumers any less wary in the wake of a tumultuous first quarter of 2025.

Shoppers Focus on Necessities

Radial’s research found that today’s shoppers act strategically. They are price sensitive and shift priorities to plan seasonally and stockpile when necessary. They make decisions not only based on need, but on value, timing, and trust.

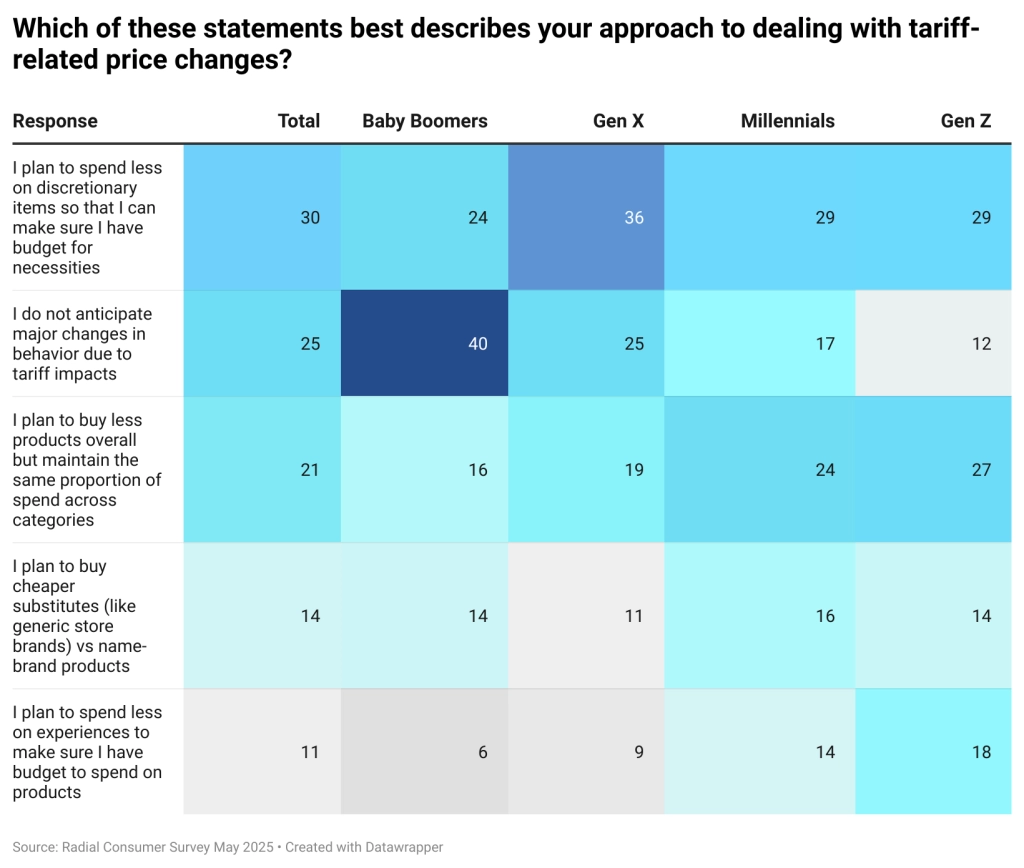

Consumers first focus on necessities. Thirty percent of consumers plan to spend less on discretionary items to ensure they have money for what they need. And 21% plan to buy fewer products overall. Only 14% plan to switch to cheaper substitutes. While 28% of shoppers are interested in American-made products regardless of price, 30% still prioritize price over manufacturing location.

Consumers Call for Tariff Transparency

Tariff changes cause shoppers to ask for greater transparency. Fifty-two percent of consumers want tariffs listed as a separate surcharge—a sentiment strongest among lower-income households (64% of those earning under $25K). In contrast, 58% of those earning over $200K are comfortable with bundled pricing. Brands may need to personalize pricing displays or checkout language to maintain trust across segments.

For business leaders, it’s important to recognize that value isn’t just about price for consumers—it’s about how clearly and confidently brands communicate what shoppers are paying for.

Consumers Watch Prices but Also Expect Quality Products

Modern brands should not focus solely on pricing as the path to win and keep customers. Per Radial’s research, consumers care deeply about quality as well. Per Radial’s tariff survey, only 14% of consumers plan to switch to cheaper alternatives. And 32% of consumers say product quality is the top reason they choose to buy from a DTC brand. Twenty-nine percent are motivated by access to unique products they can’t find anywhere else. Sixty-two percent of consumers say that declining product quality will cause them to lose trust in a brand. In some categories, consumers will likely refocus on higher quality products. Quality matters, so as retailers are looking for ways to manage uncertainty, a focus on quality can be a strategic path to success.

And it’s not only product quality that drives customer loyalty. Quality fulfillment is also key to winning customers.

Customers Stop Shopping Over Poor Fulfillment

Radial’s research shows that operational consistency, not just a great product, is essential to building brand trust and customer loyalty. A recent Radial survey revealed that 72% of consumers say shipping speed and reliability are the most important factors in deciding whether to buy from a DTC brand. Product availability (66%) and easy/free returns (63%) rank even higher than values like brand identity or personalization.

Younger shoppers are the most likely to skip over brands due to poor fulfillment. Gen Z (35%) and Millennials (33%) expect Amazon-era convenience and report the highest frustration with delays and lack of communication. Boomers, on the other hand, are more sensitive to price-related friction, with 33% abandoning carts due to high shipping costs.

It’s not only speed and convenience. According to Radial’s May 2025 consumer survey, shoppers expect real-time product availability—especially with potential tariff-driven stockouts. Ninety-six percent of consumers rate real-time product availability as being extremely or somewhat important. Worryingly, many growing brands don’t have the operational expertise or technology solutions necessary for transparent real-time inventory management.

For DTC brands seeking to grow and scale, poor fulfillment can be a dealbreaker. Nearly 40% of consumers quit buying from a DTC brand they liked because the retailer couldn’t keep up with demand. Delayed or canceled orders (29%), unexpected shipping costs (30%), and difficult returns (24%) create a customer experience that pushes shoppers away from return purchases in the future.

Modern Brands Redefine Value to Keep Win and Keep Customers

Consumers increasingly rely on new and different cues to evaluate modern brands’ quality—and it’s often closely linked to quality fulfillment.

From reliable shipping to order transparency to easy returns, Radial’s research shows that operational consistency, not just a great product, is essential to building brand trust and customer loyalty. As 2025 rewires consumer expectations, retailers must respond. This moment demands more than tactical adjustments. It calls for a reexamination of how value is communicated, how fulfillment operations meet consumer expectations, and how product origin and availability influence loyalty. The shopper has evolved—and retail strategies must evolve with them.

The good news: Modern brands can rely on trusted partners to help them evolve their fulfillment.

Drive Quality with Radial Fast Track

Modern brands don’t need to navigate supply chain uncertainty and high customer expectations alone.

Radial has the solution: Radial Fast Track. Radial Fast Track provides scalable, cost-effective fulfillment for modern brands, without upfront costs or long-term contracts. All backed by Radial’s simplified operating model, cutting-edge technology, and 40+ years of logistics expertise.

Radial Fast Track can help solve a variety of challenges:

- Expand your brand, grow, and scale: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly.

- Transition from in-house fulfillment to outsourced fulfillment: Onboard fast, with the ability to integrate in as little as a week—minimal resources required. We streamline fulfillment so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Navigate transportation and returns challenges easily: Get faster, cost-effective shipping no matter the size of the organization. Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost—and we handle returns for you.

Get started with fast, scalable, cost-effective fulfillment.