Don’t Wait for the Holiday Season to Focus on Scalable, Quality Fulfillment

Retailers shouldn’t wait for the holidays to focus on quality fulfillment. Modern brands can optimize now to meet customer expectations.

It’s still the peak of summer in the northern hemisphere, but many retailers are already preparing for a different peak: 2025’s holiday season. For many brands, the Q4 holiday shopping period represents the busiest time of year as consumers clamor for new products across categories. But 2025 may bring a different style of shopping season, and retailers should start preparing now.

Consumers May Approach the Holidays with Caution

While consumer sentiment improved as potential tariff threats and corresponding economic anxiety eased in July, new tariff announcements may cause them to shop with renewed caution. Per a recent Radial tariff survey, 95% of consumers are aware of tariff increases, and 74% say they’ve already changed or plan to change how they shop. Only a quarter expect no change at all. Tariff changes mean wary shoppers in the wake of a tumultuous first half of 2025.

Cautious consumers may shift spending patterns ahead of the holidays, focusing on essentials and promotions or sales, while reducing purchases in other categories. They’re already demonstrating caution early with back-to-school shopping. Per PwC data, 37% of shoppers purchase back-to-school items only when they are on sale. This data aligns with Radial’s research, which indicates that 30% of consumers plan to focus on necessities first.

Consumers Will Monitor Sales and Shop Strategically

Consumers have high expectations for brands this holiday shopping season. First, they will be looking for the most value for their dollars. Radial’s July 2025 consumer survey indicated 34% of shoppers will focus on deals and promotions this holiday season, while 22% are shopping earlier to avoid shipping delays. Retailers can continue to capture sales with careful pricing strategies, as well as by shaping demand via promotional events and pre-holiday sales.

Shoppers Balance Affordability and Quality

Shoppers will tackle holiday shopping strategically, focusing on getting the most value for their dollar. While that means modern brands will need to assess their pricing strategies to both meet customer expectations and balance tariff costs, it also requires them to meet consumers’ quality expectations. Per Radial’s research, consumers care deeply about quality. Only 14% of consumers plan to switch to cheaper alternatives over tariff cost increases. And 32% of consumers say product quality is the top reason they choose to buy from a modern brand. Sixty-two percent of consumers say that declining product quality will cause them to lose trust in a brand. That means modern brands simultaneously experience pricing pressures while also needing to invest in quality products.

Customers Crave Fast, Flexible Delivery and Easy Returns

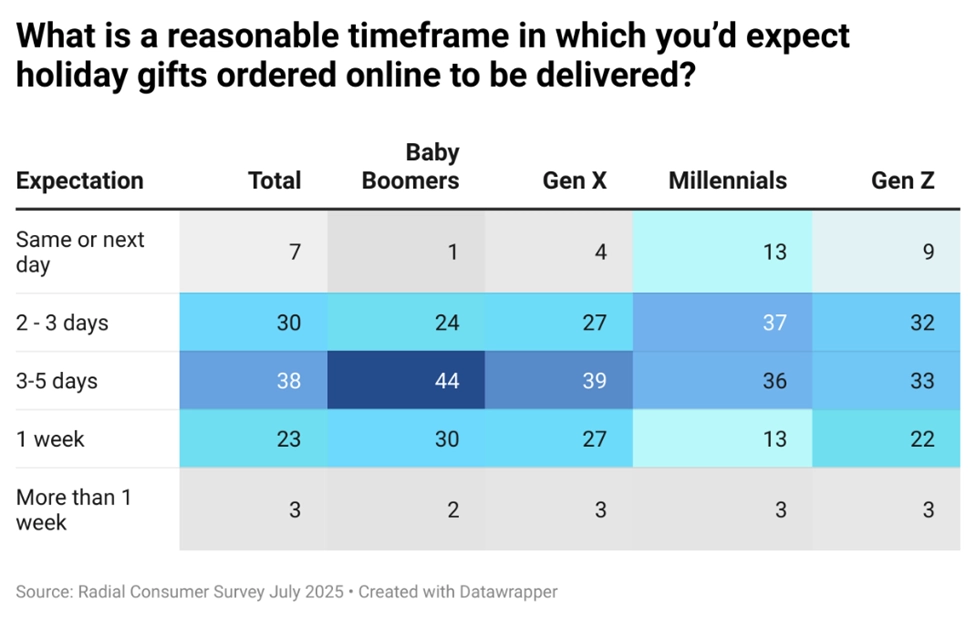

Brands must also meet their customers’ fulfillment and delivery expectations. But that doesn’t mean they must always chase Amazon-era speeds to do so. Per Radial’s July 2025 consumer survey, 30% of shoppers expect an online order delivered in 2-3 days, with only 7% expecting it the same or next day. The highest percentage (38%) are willing to wait between 3 and 5 days. So while consumer expectations are high, they are manageable with the right mix of providers and planning.

Shoppers likewise expect an easy returns process, especially during the post-holiday returns period. And they abandon brands when they provide poor experiences. Seventy-three percent of consumers claim they will not purchase again from a retailer that provided a poor delivery or returns experience during the holiday season.

Ultimately, modern brands don’t have to offer the fastest delivery experiences to still meet customer expectations during the holidays, but they do need to be pretty fast and very reliable. This means it is imperative to explore solutions and partnerships that allow them to boost predictability—from delivery speed to returns processes.

Consumers Stop Shopping Over Poor Fulfillment

Consumers expect great fulfillment, and Radial’s research shows that operational consistency, not just a great product, is essential to building brand trust and customer loyalty. A recent Radial survey revealed that 72% of consumers say shipping speed and reliability are the most important factors in deciding whether to buy from a DTC brand. Product availability (66%) and easy/free returns (63%) rank even higher than values like brand identity or personalization.

Brands will lose customers across demographics over poor fulfillment, but they will lose younger shoppers first. Gen Z (35%) and Millennials (33%) expect convenience, and they report the highest frustration with delays and lack of communication.

Retailers Can’t Afford to be Frozen by Indecision or Poor Fulfillment

A tumultuous first half of the year led many retailers to focus on short-term tariff cost mitigation strategies and even pause other, longer-term operational efforts. They can’t afford to wait much longer if they want to optimize their fulfillment for peak.

But brands face an operational challenge: Per Radial’s Q2 2025 retailer survey, the majority of modern brands still rely on in-house fulfillment solutions with either multiple (70%) or single (59%) facilities for at least some of their fulfillment needs. Only about 40% or less rely on outsourcing to manage some or all of their fulfillment needs.

In-house fulfillment works for emerging brands, but it creates challenges as brands grow and operations become more complex. It is resource intensive and needs capital to scale. Worse, it leaves brands underequipped and unable to respond to peak demand surges flexibly. The result: lost customers due to poor fulfillment experiences.

Modern Brands Redefine Quality Fulfillment to Win Peak Season Sales

It’s not too late for modern brands to optimize fulfillment for this year’s holiday season. And it’s worth the effort.

From reliable shipping to order transparency to easy returns, Radial’s research shows that operational consistency is essential to building brand trust and customer loyalty. But it requires a reexamination of how quality is communicated and how quickly fulfillment operations are optimized to meet consumer expectations. Traditional fulfillment solutions won’t cut it, but there’s good news: Modern brands can rely on trusted logistics partners to help them evolve their fulfillment rapidly—before peak season.

Brands Trust Radial Fast Track to Scale for Seasonal Peaks, and for Quality All Year Long

Brands don’t have to wait any longer to implement scalable fulfillment for the 2025 holiday season. And they don’t need significant resources or capital to quickly evolve their operations either.

Radial has the solution: Radial Fast Track. Radial Fast Track provides scalable, cost-effective fulfillment for modern brands, without upfront costs or long-term contracts. All backed by Radial’s simplified operating model, cutting-edge technology, and 40+ years of logistics expertise.

Radial Fast Track can help create customer-centric fulfillment for peak season and beyond:

- Expand your brand, grow, and scale amid seasonal peaks: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly.

- Transition from in-house fulfillment to outsourced fulfillment: Onboard fast, with the ability to launch in as little as a week—minimal resources required. Our streamlines operating model and intuitive technology make fulfillment easy so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Navigate transportation and returns challenges easily: Get faster, cost-effective shipping no matter the size of the organization. Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost—and we handle returns for you.

Get started with fast, cost-effective fulfillment.