Why New US Tariffs Have Brands Looking for FTZ Warehouses

A strategy to manage tariffs has recently reemerged in logistics conversations: The FTZ warehouse. Let’s review the definition of FTZ warehousing, and why brands may be seeking them out to navigate tariff uncertainty.

Retailers and shoppers alike are still navigating the rapid evolution of US tariff policy in 2025. The Trump administration initiated a series of major tariff changes this year, as well as ending the de minimis tax exemption. This changed how businesses operate and consumers shop as import costs increase, and it creates challenges for modern brands seeking to manage costs and maintain healthy cash flows. Many of these brands need new strategies to optimize their supply chains while these tariffs are in effect.

There’s one strategy that’s recently reemerged in logistics conversations: The FTZ warehouse. Let’s review the definition of FTZ warehousing, and why brands may be seeking them out to navigate tariff uncertainty.

The Definition of FTZ Warehouse

A Foreign-Trade Zone (FTZ) warehouse is a secure, designated area in the US that exists outside of US customs territory. It is under US Customs and Border Protection (CBP) supervision. This lets retailers import and hold inventory in the US without paying applicable duties when the goods enter the country. The associated duties are instead paid after the inventory is sold. That means retailers and brands can use FTZs strategically to manufacture, store, repackage, and inspect goods before they pay associated duties. They only pay when the inventory is sold or moved to a non-FTZ location within the US market.

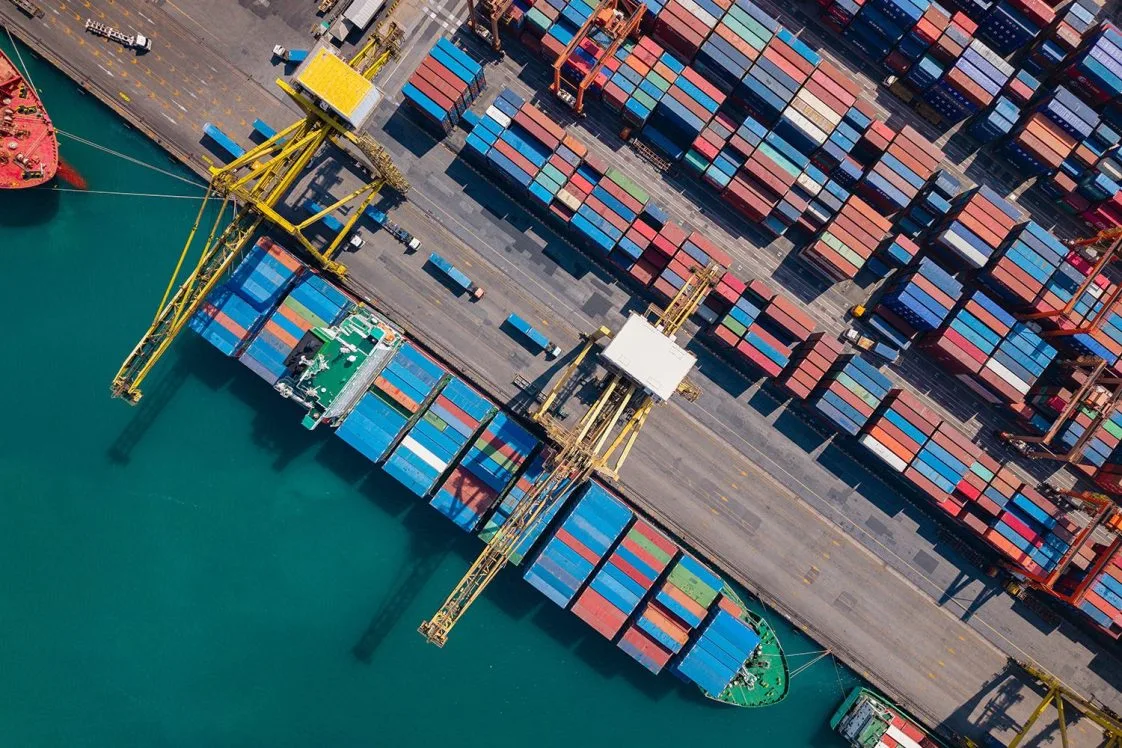

These warehouses are typically located near shipping ports, airports, or industrial hubs. That way, brands can reduce the time, resources, and costs required to import, ship, and store inventories.

How FTZ Warehouses Work

Brands import goods and ship them to a designated FTZ warehouse, where they exist in a “duty suspension” state legally outside of customs territory. Shipments will arrive under CBP supervision, but they do not incur duties. Once in an FTZ warehouse, retailers maintain control over inventories while retaining the flexibility created by not having to pay duties up front.

Why FTZ Warehouses Can Help Brands Navigate Tariff Changes

Tariff changes mean brands importing goods into the US need new strategies to remain competitive. An FTZ warehouse helps brands stay flexible and efficient while delivering real savings. FTZ warehousing means brands can:

- Defer Duties: Retailers only pay duties when products are sold within the US or moved to a non-FTZ location—and only if this occurs. This improves cash flow, since retailers retain the money they would immediately spend on duties until after a sale is made.

- Manage Tariff Impacts and Simplify Re-Exporting: FTZ warehouses can provide specific tariff benefits to retailers, reducing overall rates for finished goods, streamlining processing fees, and even allowing brands to sidestep US tariffs for internationally bound orders stored in the US.

- Improve Cash Flow: FTZ warehouses allow retailers to defer paying duties until goods are sold. This creates significant cash flow flexibility, with the preserved capital being available for other strategic efforts.

- Reduces Administrative Costs: With an FTZ warehouse, retailers can consolidate multiple shipments under a single processing fee, and there are fewer reconciliations and filings required.

- Order Processing and Fulfillment in the Same Facility: Unlike another solution like bonded warehouses, retailers can both process orders and fulfill them in the same facility. This streamlines operations and improves fulfillment and delivery to customers.

Brands Can Partner with a 3PL to Streamline the FTZ Warehouse Process

Retailers can operate their own FTZ warehouses, but that requires capital, resources, and knowledge of the unique regulatory and compliance elements required in these facilities. Alternately, modern brands can work with third-party logistics (3PL) providers to simplify the entire import and fulfillment process. This allows brands to focus on their core competencies while outsourcing the complex process of setting up and operating FTZ warehouses.

There are other benefits to working with a 3PL to manage FTZ facilities:

- Simplify re-exporting: 3PLs can help brands re-export goods stored in FTZ warehouses, removing the burden of managing the process and compliance requirements.

- Create simple, fast implementations: Setting up and activating an FTZ warehouse is a complex and time-consuming process. Retailers can reduce the complexity by relying on a trusted 3PL partner with existing FTZ facilities. That makes implementation easy and fast. Plus, brands don’t need to leverage in-house resources to manage operations, administrative requirements, and compliance.

- Lower costs and improve cash flow: 3PLs optimize operations to reduce administrative and other logistics costs—all while retailers enjoy the improved cash flow created via the FTZ warehouse.

- Leverage years of dedicated logistics experience: Retailers don’t necessarily have the depth of logistics expertise necessary to manage FTZ warehouses effectively. That’s why it is often better to rely on a trusted 3PL with deep expertise and experience. They can then meet the challenges, and maximize the opportunities, on behalf of retailers and brands.

Learn more about FTZ warehousing solutions.