How the Change of a Tax Exemption Impacts and Resets Buying Behavior on International Marketplaces

Radial conducted a consumer survey focused on changes to the de minimis exemption. It’s reset shoppers online spending habits considerably.

The first half of 2025 saw business leaders and consumers focus primarily on the impact of US tariff changes amid economic uncertainty. But the current US administration also changed a key tax exemption in April 2025, one that is rewiring buying behavior throughout the rest of the year: the de minimis exemption.

Radial recently conducted a consumer sentiment survey focused on changes to the de minimis exemption—and what it means for US consumers and international eCommerce marketplaces moving forward in 2025. In short, it is rewiring shoppers’ online spending habits considerably.

What is the De Minimis Tax Exemption?

The de minimis exemption defines the minimum value threshold under which tariffs and import duties are waived. President Trump signed an executive order in late July ending the de minimis trade exemption for all packages shipped from other countries. The de minimis exemption defines the minimum value threshold under which tariffs and import duties are waived. On August 29, all shipments with goods originating internationally will be assessed for tariffs, duties, and taxes and require formal clearance. This is in addition to the end of de minimis exemption for goods originating in China which occurred in May 2025.

The end of de minimis signals headwinds for international brands shipping directly to US consumers. They will need to reevaluate their fulfillment strategies and potentially pursue a US-based fulfillment strategy.

Tax Exemption Changes Create Headwinds for International Marketplaces

De minimis helped international eCommerce marketplaces like Temu and Shein enter the US market with low-cost goods shipped quickly and cheaply. They could ship inexpensive products direct to the US easily under the exemption, avoiding duty and tax. With changes made to de minimis, consumers will likely have to pay more to buy from these brands when they directly source from China and other nations, as tariff rates and import clearance fees will now be part of the equation. While these companies have sought to shift their US operating models to have more domestic US inventory or looked to move sourcing to less tariff-impacted countries, much of their products still come direct from China.

So have US consumers reacted to the changes created by the end of de minimis for Chinese goods—and how do they plan to shop in the future?

The End of De Minimis Changed US Buying Behavior

Per Radial’s June consumer survey, more than two-thirds of consumers have shopped from international platforms like Temu or Shein in the past year. Aside from price, they largely chose these platforms for their selection of goods and for the ability to experiment without risk. Younger generations especially flock to these international marketplaces. Nearly 80% of Millennials and Gen Z shopped from them.

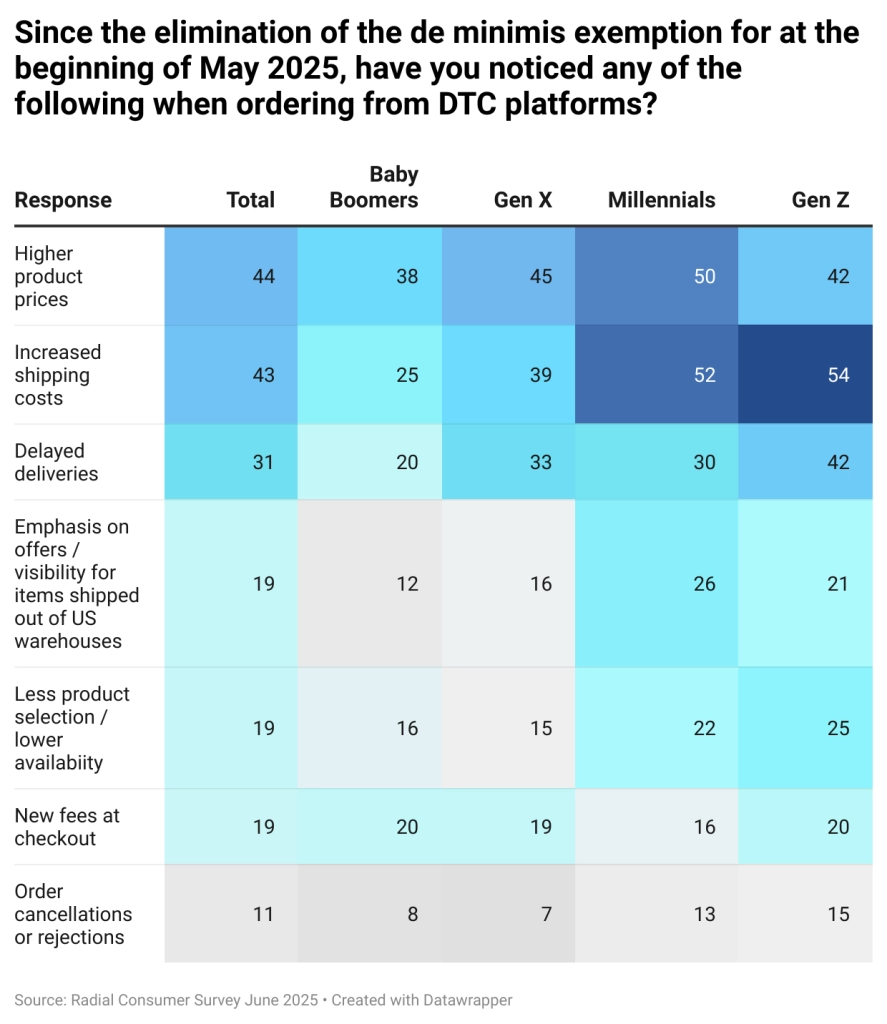

And shoppers noticed when the end of the de minimis exemption forced international brands to shift logistics strategies. They are noticing higher product prices (44%), increasing shipping costs (43%), and delayed deliveries (31%). This is especially true for the demographics that shop these marketplaces the most: Millennials and Gen Z. These changes affect whether or not some shoppers return. Per Radial’s survey, 45% of consumers decreased or stopped buying from these platforms since the de minimis change occurred. One strategy that these platforms utilized to maintain sales amidst the challenges has been to source more from US locations and communicating when that is the fulfillment path. Their customers noticed—about a quarter of Millennials and Gen Z recognized this change.

Gen Z Flocked to International Marketplaces but Slow Down Without De Minimis

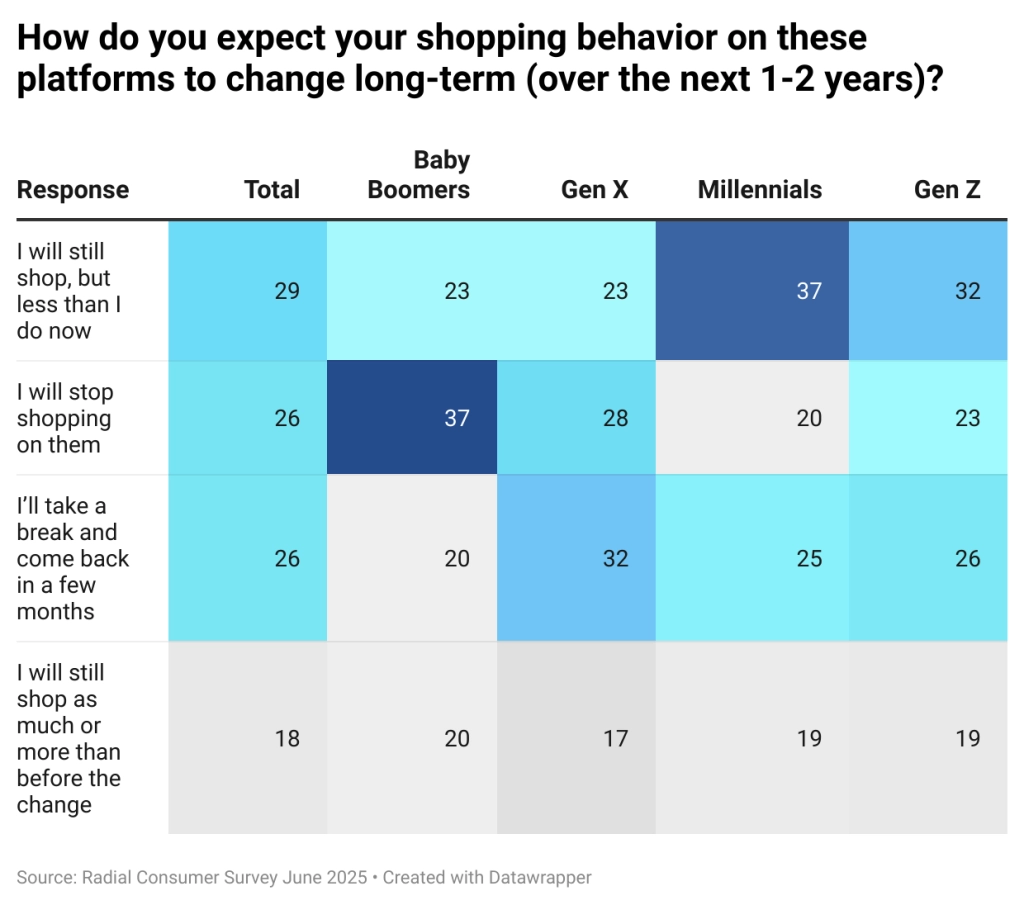

Over 80% of surveyed Gen Z shoppers purchased from international marketplaces like Temu or Shein in the past year. They shopped in far higher numbers than older generations. But the end of the US de minimis tax exemption caused up to 23% of Gen Z and 20% of Millennials to stop shopping on these platforms. Over 25% of Millennials and Gen Z plan to take a break for at least a few months before checking to see if it’s still worth shopping with affected brands.

Older generations likewise signal a slowdown in spending, but at higher rates. Thirty-seven percent of Baby Boomers plan to stop shopping on these platforms, with Gen X following at 28%. It should be noted that these generations shopped less often on international platforms, with 54% of Baby Boomers and 28% of Gen X never planning to purchase on them, indicating their slowdown may be less impactful. But the loss of younger customers may ultimately create greater challenges for these brands.

While many consumers still intend to shop with brands affected by the loss of de minimis exemptions, they still plan to do so less often. Only 18% of all consumers plan to shop as much or more than before the loss of the de minimis exemption.

International Brands Can Refocus on Younger Core Customers in the US and Beyond to Remain Competitive

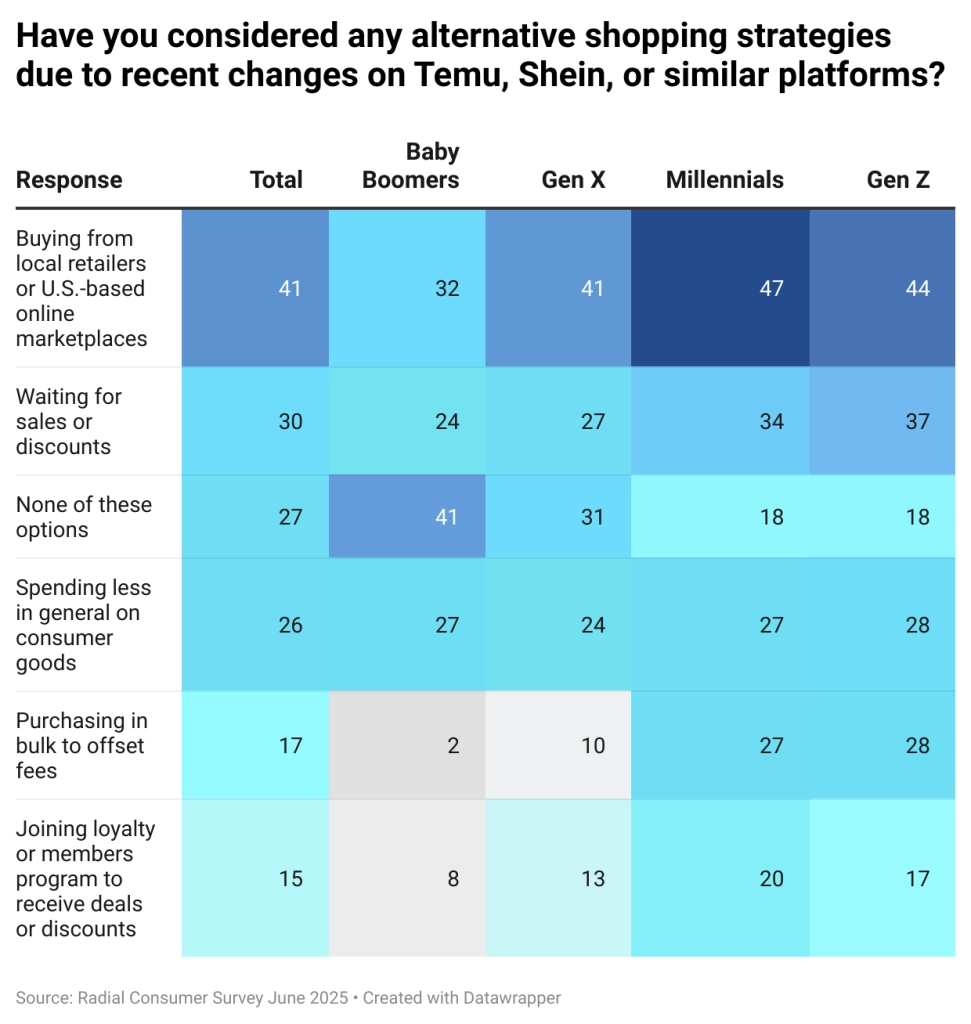

As some US consumers pivot back to more traditional retailers and marketplaces, international brands can still redefine their strategies to win US business and beyond. To win back the largest share of shoppers, international marketplaces can analyze pricing and promotion strategies. Sales and discounts attract 37% of Gen Z and 34% of Millennials. Gating promotions and discounts behind a loyalty program may sound attractive but is not favored by a significant percentage of any demographic apart from Millennials.

Alternately, retailers can reassess shipping fees and thresholds. Fast, free shipping is important to younger demographics, and over a quarter of Millennials and Gen Z may purchase in bulk to offset fees.

US Brands Can Benefit from the Shift in Competition by Focusing on Quality

Customers are increasingly focusing on quality when shopping across product categories. Per Radial’s research, 32% of consumers say product quality is the top reason they choose to buy from a brand, and 29% are motivated by access to unique products they can’t find anywhere else. Sixty-two percent of consumers say that declining product quality will cause them to lose trust in a brand.

International brands took advantage of the de minimis exemption to ship low-cost, often lower quality products to the US. With the end of the de minimis exemption, US brands can now take the opportunity to win over new customers and capture market share by focusing on the higher quality products that consumers want.

International Marketplaces Fulfill from the US for Long-Term Success

While many international marketplaces partially pivoted to other markets like Europe after the de minimis loophole closed, there are still opportunities to capitalize on US demand. One path forward involves creating a US-based fulfillment strategy for US customers. In fact, Temu already leverages local fulfillment to manage tariff and de minimis costs.

While importing products to the US may incur tariff costs, US-based fulfillment creates opportunities for international brands still seeking to win over US consumers. They can avoid de minimis costs and also meet US consumers high fulfillment and delivery expectations. Brands win customers’ loyalty when they provide quality fulfillment experiences, and 72% of consumers say shipping speed and reliability are the most important factors in deciding whether to buy from a DTC brand. International marketplaces can invest in US-based fulfillment strategies, and work with quality US logistics partners, to drive long-term success, despite de minimis setbacks.

Radial Fast Track Supports Growing Brands

For many international brands, working with a US-based logistics partner can create long-term success while reducing the risks market expansions often incur. For example, Radial has 40+ years of operational experience and has supported many international brands seeking to enter new markets in the US and Canada.

And Radial has a track record of successfully partnering with US-based brands seeking to win customers through quality fulfillment. With Radial Fast Track, brands from all over the world can help solve a variety of challenges when entering new markets and scaling to meet customers’ expectations:

- Expand your brand, grow, and scale: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly from Radial facilities.

- Access outsourced fulfillment fast: Onboard fast, with the ability to integrate in as little as a week—minimal resources required. We streamline fulfillment so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Navigate transportation and returns challenges easily: Get faster, cost-effective shipping no matter the size of the organization. Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost—and we handle returns for you.

Get started with fast, cost-effective fulfillment.