Why You Need a Dedicated Chargeback Management Team

Many eCommerce merchants feel that they do not have the time or bandwidth to monitor and manage chargebacks and decide it’s just a price of doing business.

By: Chitra Singh

Mastercard reports that merchants will pay out $1B in chargebacks this year. While the chargeback process originated as a protective measure for customers to have a recourse of action against merchants that do not fulfill their promises, today, 61% of chargeback claims are fraudulent. Despite these statistics, many eCommerce merchants feel that they do not have the time or bandwidth to monitor and manage chargebacks and decide it’s just a price of doing business. But can you really afford to do so?

Merchants that pay out on claims without investigating and challenging each claim leave money on the table and expose themselves to continual chargeback abuse. High rates of chargebacks can also damage a merchant’s credibility with banks and payment processors. The goal of chargeback management is that good customers with valid claims are issued their refund. Fraudulent customers with invalid claims have their claims denied – and their profiles flagged to help prevent future losses. Figuring out the legitimate from unwarranted claims is a complex, time-consuming investigative process, bound by various rules and timelines, that must be completed by a team of human experts.

But few merchants develop this team in-house and instead have their customer service, fraud, or finance departments try to tackle it. Without a dedicated team of chargeback experts, it can be very difficult to recoup losses.

In my work with merchants, I’ve seen the value of having a specialized team working daily on your behalf and on the behalf of your customer’s best interests. While there is never any guarantee that a claim will be reversed, it is worth the effort to research every claim. At Radial Payment Solutions, we’ve developed a very streamlined process and deep industry expertise so that we can identify the right evidence needed to verify or dispute every claim, very quickly, at scale. Our merchants benefit from our 25 years of managing chargebacks for eCommerce businesses.

I am often asked about the chargeback process and how Radial benefits merchants.

A Complex Chargeback Claim Process

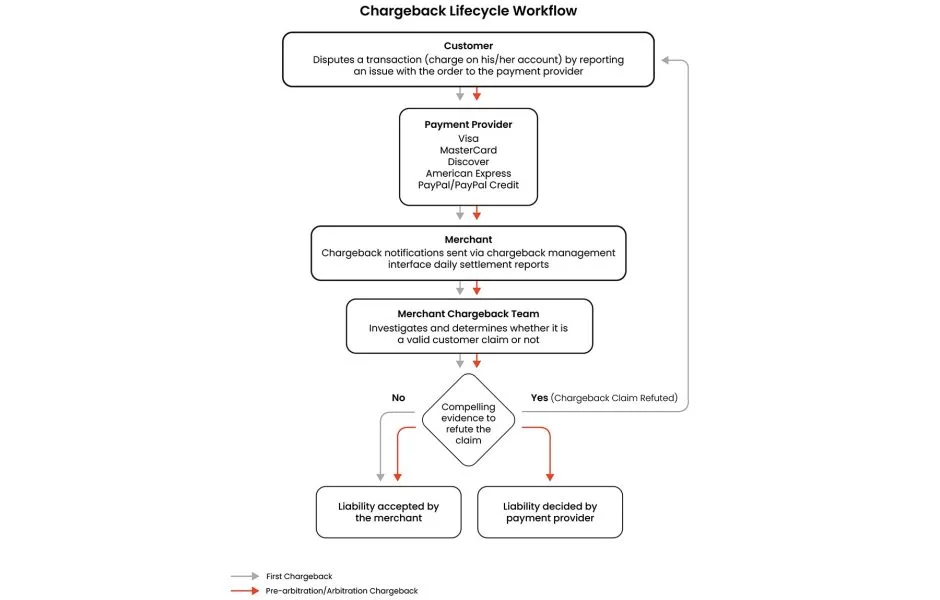

The chargeback process is a series of interactions between several participants. It takes place in four phases – each of which has a set time limit to be completed, and has unique parameters and rules set by the payment provider. The following chart outlines how the process flows.

At Radial, my team and I handle all four phases of the chargeback lifecycle – retrieval, first chargeback, second chargeback, and arbitration chargeback. During the first three phases, all parties are trying to mutually resolve the chargeback issue with the cardholder. If we determine that the claim is legitimate, it gets resolved quickly. If we determine that it should be disputed, we must build a framework of acceptable compelling evidence to support our case. This is where it gets time-consuming, and where, as experienced professionals, we know what evidence to look for and whether it will align with the compelling evidence rules determined by each payment provider. When you have been doing this for more than a decade, as I have, you develop an eye for what each reason code in the chargeback requires and the best way to build evidence.

My team and I are dedicated to not only resolving claims for the best and honest outcome for the parties involved, but to remedying the root cause of the chargeback. This means we look for the underlying cause of claims and inform merchants of any trends that we see. We also inform our fraud department so that they can update their data. Our data sharing process happens automatically now, in real-time, so that as soon as we make a determination, it is shared across the Radial network and future fraud by that cardholder is mitigated. We see this as an added layer of fraud protection for all Radial customers that benefit from our data network.

What does this all look like in real life? Here is a story of a case that we worked on for one of our merchants.

$13.5K Worth of Goods Not Delivered. Or Were They?

A customer ordered a single online transaction of luxury merchandise totaling $13,500 USD. During order processing, the online order was flagged for manual review by the merchant’s third-party professional fraud investigators. The order information was verified with the customer by phone, as well as with the credit card issuing bank prior to approval. With all information verifying and matching to the customer, the order was processed and fulfilled. The shipment was confirmed to be delivered and received by the customer including a signature confirmation, per the carrier’s website.

The customer initiated a refund request with the merchant’s customer service, claiming she did not receive the merchandise. There had been multiple communications with this customer prior to the customer reporting the chargeback with customer-provided inconsistent information.

At first, the customer claimed to have received and signed for the high value merchandise and that she had returned it for a refund. The merchant, however, received an empty box as the return. The customer then changed her stance and claimed to not have received the merchandise and that she was advised to send the empty box back to the merchant. The merchant said that they had no record of any such communication or interaction.

The customer then claimed to not have called the merchant’s customer care team but had used the online return system. She claimed that the shipment box she received was damaged but sealed, and the merchandise was not in the box. The merchant’s security team reviewed the video of the high value merchandise being packaged and shipped properly. They advised the customer to have the shipment carrier investigate, but the customer did not provide the necessary evidence for the investigation to be carried out. As a result, the merchant denied the refund request.

This is when the customer decided to initiate a chargeback. She disputed the charge with the card issuing bank, claiming she did not receive the merchandise. The merchant’s Radial chargeback team reviewed the customer’s transaction history and interactions with the merchant’s customer service team. They suspected that this was a case of claims process abuse.

The Radial chargeback team conducted an extensive review of the claim and confirmed the merchandise was packaged and shipped in a secure environment, with due diligence. Based on the evidence, the team concluded that the claim was in fact invalid.

To refute the claim, the Radial chargeback team compiled supporting documentation that included itemized order details, proof of delivery, and proof of customer interactions. The proof of delivery was comprised of the full audit trail, from packaging at the warehouse and delivery by the carrier to a delivery confirmation receipt with the signature proof.

Since the standard proof of delivery required by the payment processor dispute rules may not have been sufficient, the Radial chargeback team worked together with the merchant, carrier, and payment processor teams to carefully analyze and gather all additional compelling evidence to refute the customer claim. With the merchant’s cooperation, the chargeback team even collected a video recording of the merchandise being packed and shipped. The combined evidence made a strong case that the customer received her merchandise and was issuing a false claim.

Passionate About Protecting Merchants and Their Customers

Many chargebacks are not this detailed, but we believe in leaving no stone unturned. At Radial, customer experience is most important to us. We want to be sure that if the customer is right, they don’t have to wait 30 days if they’re due a refund. And in working to that end, we are upholding our merchant’s promises to their customers and helping them to preserve or rebuild trust. For merchants, we are equally devoted to protecting their revenue and reputation. We continually fine tune our strategy, because we know that at the end of the day, the process does not have a guarantee of reversal, so we work hard to make sure our merchants have every chance.

Chargebacks are a part of doing business, but they don’t have to be an unmitigated cost. With a dedicated team of chargeback specialists working for you, you can be sure that your revenue is proactively protected and that your legitimate customers are being treated with respect.

How much can Radial save you on fraud? Find out with our fraud calculator.

Radial can help you save on fraud.