Fraud Protection: Striking the Right Balance Between Automated and Manual

Whether your brand sells merchandise in a store, on an ecommerce website or through a mobile app, you need to protect against retail fraud. And you want that fraud protection to occur quickly and accurately.

Whether your brand sells merchandise in a store, on an ecommerce website or through a mobile app, you need to protect against retail fraud. And you want that fraud protection to occur quickly and accurately.

Automation can help. In the past few years, advances in artificial intelligence (AI) capabilities such as machine learning (ML) have enabled sophisticated fraud review to take place in milliseconds. That development has led some fraud-protection vendors to relegate all fraud processes to automated tools.

But even the best ML today still generates an unacceptable number of false-positive declines. For that reason, some vendors cling to manual fraud review – a time-consuming and potentially high-cost process.

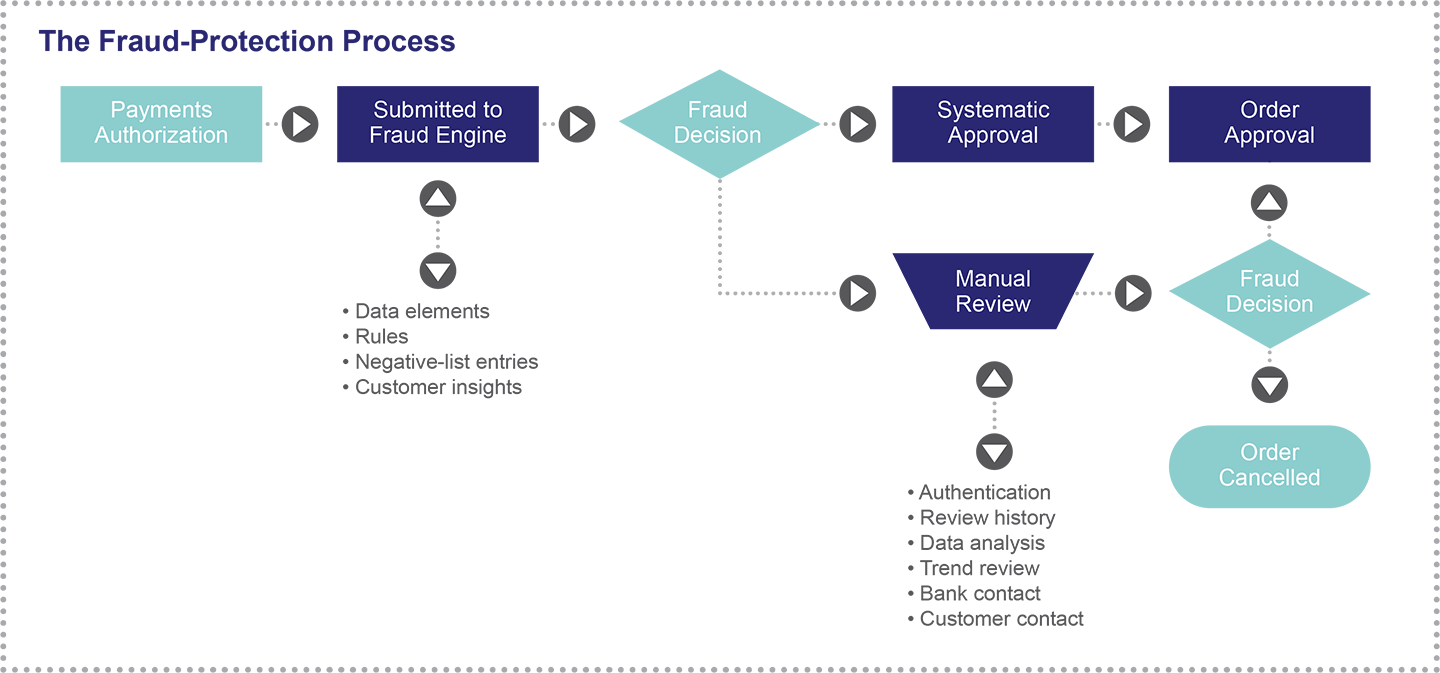

The solution is a blended approach that begins with advanced ML algorithms and augments the process with data analysts for optimal fraud protection with minimal false positives.

Choose Your Protection

In fact, a blended approach is a virtual requirement for fraud-protection providers that offer indemnification – assuming the merchant’s responsibility for any chargebacks. Neither automation nor manual review alone is accurate and timely enough to make indemnification practicable.

Of course, there are times when one or the other approach is most effective. If you’re selling goods the user would expect to access immediately – such as instant download of a computer game – then fraud analysis needs to be instantaneous, and there’s no time for manual review.

But manual review can allow for successful order conversions that ML would otherwise decline. Let’s say you have a transaction that ML would decline because of a medium risk score. Manual review could show that it’s a good customer and that data points such as proxy IP and email address are never seen yet valid. So, you avoid declining the tender and retain your relationship with a good customer.

Or let’s say ML would approve a transaction because the data points are valid. But human review reveals that it’s actually an account takeover. You avoid a fraudulent purchase and chargeback that ML would have missed.

The human touch is also required to continually improve ML algorithms. Data scientists need to evaluate ML performance and train the ML models. Ideally ML should become more accurate over time, and the purpose of manual review will change accordingly.

Getting the Right Fraud-Protection Answers

To determine whether your fraud-protection vendor uses the right balance of automated and manual processes, ask these questions:

- How long does review take? Automated review should occur as close to instantaneously as possible. Manual review should occur fast enough to meet the service-level agreements (SLAs) that are right for your business model. Both processes should be transparent to your customers.

- What percentage of orders involve manual review? Manual reviews are sometimes necessary. But depending on your industry segment, ideally you want to drive down their proportion of all transactions to less than 2% – and certainly far lower than the more common 15%.

- What are your hours of operation? Ecommerce takes place around the clock. Your fraud protection should keep pace.

- How do you update your ML models? Your vendor should continually backfill its ML models and decision trees with updated data, and those updates should occur quickly. When your provider first turns on the service, you should expect approval rates to be lower at first but then rapidly improve.

- Can you scale for peak? Manual processes don’t scale as easily as automated ones. But your company might earn a large portion of its revenue at peak times of the year. Your vendor should be able to keep up, even with manual reviews, so that fraud protection never impedes your conversion rates.

The right combination of automated and manual fraud protection ensures a low number of rejected orders, a minimal amount of human intervention and zero chargebacks to your business. The result should be a positive experience for your customers and a healthy revenue stream for you.

Tyler Hodgins is a senior solution consultant for Radial.