How First-Party Misuse Negatively Affects Merchants

Dive into Radial’s insights on first-party misuse and its affects on eCommerce merchants.

First-party misuse occurs when a legitimate cardholder authorizes a purchase, receives the goods or services, and later disputes the charge. In effect, the customer exploits chargebacks, refund policies, or merchant rules to get their money back. Common scenarios include:

- Chargeback Fraud/Cyber-Shoplifting: Intentionally making a purchase with the plan to dispute it and get the goods for free.

- Friendly Fraud: Unintentionally filing a chargeback because the customer doesn’t recognize the transaction description or forget the purchase.

- Buyer’s Remorse/Policy Abuse: Disputing a charge after second thoughts (or exploiting a merchant’s return policy) to reverse the transaction.

Industry Benchmarks vs. Radial Insights

The 2025 Merchant Risk Council (MRC) Global Fraud & Payments Report shows that 39% of surveyed merchants experienced first-party misuse, and 62% say the problem rose by at least 5% over the past year.

Inside the Radial network, the picture is similar: 46% of brands experienced first-party misuse between March 2024 and March 2025.

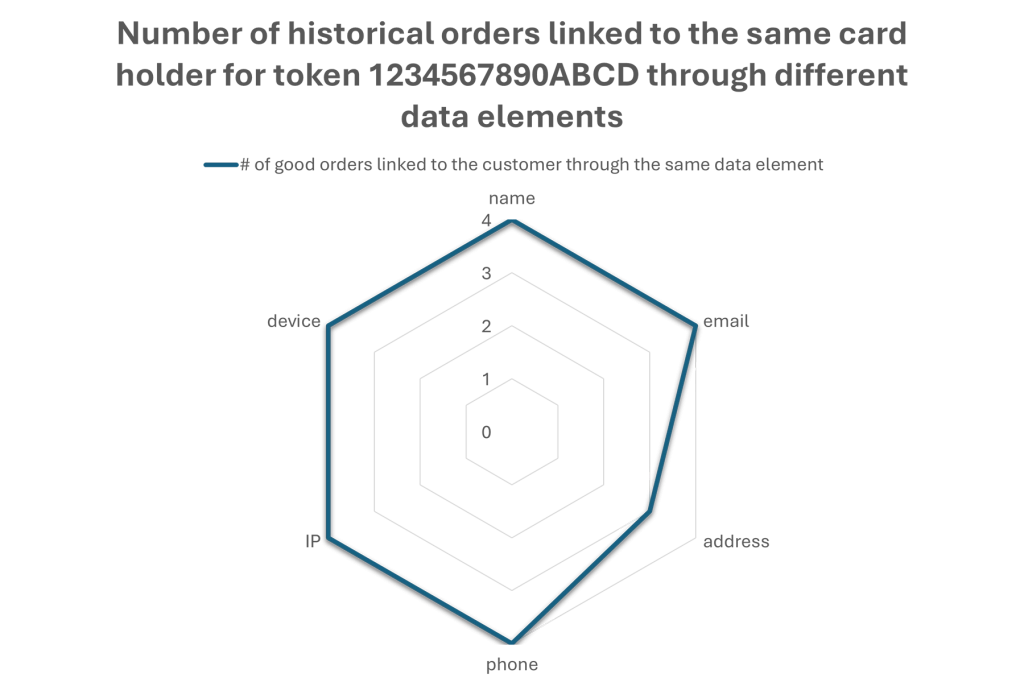

Consider one anonymized case: In May 2024 “Customer A” visited an online jeweler from “DEVICE-A” behind “IP-A” and used tokenized card 1234567890ABCD to place four small orders. The order was for bracelets and silver earrings worth a combined $320, shipping to two nearby residential addresses. All deliveries were confirmed and no disputes followed. Six months later, during the 2024 holiday season, the same device, IP block, and payment token appeared again. This time Customer A bought a $2,000 diamond wedding band and requested overnight shipping to one of the previous addresses. Delivery was confirmed, but weeks later the shopper claimed the charge was unauthorized and filed a chargeback, saying that the goods were never received.

The radar chart below visualizes how many prior legitimate orders link back to the same cardholder through multiple data elements (email, phone, device, IP, address and name), which gives analysts high-confidence signals that this is a first-party misuse case rather than third-party fraud.

Impacts on eCommerce Merchants

First-party misuse significantly impacts eCommerce merchants through both direct financial losses and increased operational costs.

Financial Losses

- Lost revenue and goods: When a customer disputes a transaction due to friendly fraud or return abuse, the merchant loses not only the sales revenue but also the product (if it has already been delivered). The cost of fighting friendly fraud is estimated at $35 per $100 in disputes, according to the Federal Reserve Bank of Atlanta. The National Retail Federation calculated the return fraud alone drained $101 billion from retailers in 2023.

- Chargeback fees: Payment processors and card networks typically charge fees for each chargeback, regardless of the outcome. These fees can range from $20 to $100 or more per chargeback.

- Increased processing fees and penalties: Excessive chargebacks can land a merchant in Visa’s Fraud Monitoring Program (VFMP) and Mastercard’s Excessive Chargeback Program (ECP), triggering higher interchange, rolling reserves, or even account termination.

- Inventory losses and restocking costs: In cases where the product is not recovered or is returned in a damaged condition, the merchant faces inventory losses and additional costs for restocking or refurbishing the product.

Operational Costs

- Fraud management and prevention tools: Merchants need to invest in advanced fraud detection and prevention systems and tools to identify and mitigate first-party fraud.

- Dispute resolution and investigations: Dealing with chargebacks requires time and resources, including staff to handle disputes, gather evidence, and communicate with banks and payment processors.

- Customer service strain: Customer service departments can face increased workload from handling numerous negative inquiries and disputes related to chargebacks.

- Metrics disruption: A high volume of chargebacks can distort sales metrics and analytics, making it difficult to assess the effectiveness of marketing campaigns, optimize product offerings, and make informed business decisions.

The Radial Difference: Radial’s Payment and Fraud Solutions

Radial’s payment and fraud solutions provide comprehensive protection against first-party misuse. Radial’s combination of breadth and depth of data, artificial intelligence and machine learning algorithms, dedicated fraud prevention team, and an efficient manual process strikes the best balance between identifying fraud and providing an exceptional customer experience. We offer:

- A data-driven approach to analyze and optimize rule strategy and quickly adapt to emerging fraud trends.

- A strong manual review support process to enhance the speed of the fraud feedback loop.

- Modernized machine learning pipelines to quickly iterate models and capture complex fraud patterns, providing robust risk signals that target first-party misuse.

- Anomaly detection processes to proactively identify suspicious activities and consumer behavior. This enables us to identify early signals of first-party misuse.

- Proactive collaboration with clients to share real-time insights and address emerging fraud threats and trends.

Visa Compelling Evidence

Since April 2023, Visa’s CE 3.0 rules allow merchants to shut down illegitimate fraud claims when they can show:

- Two prior undisputed transactions 120-365 days old that used the same card, plus

- Two matching data elements (IP, device ID, customer account or shipping address), where at least one is either IP or device ID.

Radial’s chargeback service intelligently packages CE 3.0-compliant evidence wherever appliable – device hashes, IP history, shipment tracking data, reducing merchant’s representment work and boosting win-rates.

Learn more about Radial Payment Solutions.