Peak Season is an Opportunity for Retailers to Accommodate Big Spenders

Retailers across the country are preparing for the upcoming eCommerce surge during the peak holiday season. And this year’s holiday peak is expected to be as big as ever. Last year, we saw 21% YoY growth in online sales (desktop + mobile) for the time from Thanksgiving to Cyber Tuesday.

For 2018, there are over 230 million Americans who are expected to spend $474 billion online purchases, much of which will occur in the holiday season. The surging economy is placing pressure on retailers to not only handle the higher demand, but do so with the same service level.

One segment that retailers should be especially attentive to are the Big Spenders. Big Spenders are customers who spend $500+ a year in online retail purchases. A CFI Group and Radial July survey of 500 online retail customers shows that Big Spenders make up 39% of all retail eCommerce customers.

Compared to the Small Spenders who spend under $500 a year, Big Spenders have more experience with eCommerce purchases and are savvy shoppers with heightened expectations for a smooth, well-integrated online shopping experience.

In preparation for peak season, retailers would do well to understand Big Spenders and prepare to meet their expectations.

BIG SPENDERS EXPECT INTUITIVE WEBSITE EXPERIENCES

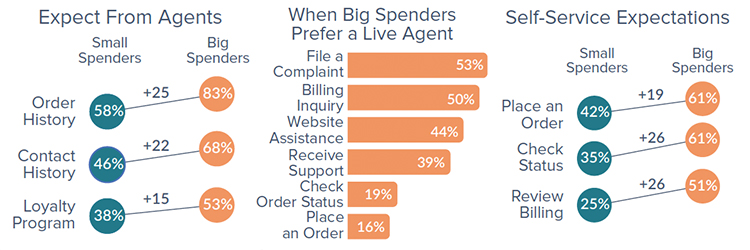

Big Spenders have high expectations for the online experience. They think that they should be able to handle the basics of eCommerce without the need to interact with a live agent. A full 61% of Big Spenders expect that an online order can be placed without needing to connect with customer service, compared to the 42% of Small Spenders who expect unaided eCommerce order placement.

Big Spenders think that checking orders and reviewing purchases online should be simple as well. 61% of Big Spenders say checking on the status of a recent eCommerce order should not require any interaction with customer service, and 51% believe reviewing billing details should also be a self-serve effort. In comparison, only 35% of the Small Spenders think checking the status of an order should be self-serve, and just 25% expect to review billing details online on their own without assistance.

BIG SPENDERS PREFER AN AGENT FOR COMPLEX MATTERS

Big Spenders expect to conduct common eCommerce activities independently without any difficulties. Only when they face an issue that is complex do Big Spenders prefer to interact with a live agent over an automated system. Only 16% of Big Spenders want a live agent instead of an automated system when needing help with placing an order, and just 19% prefer a live agent when needing assistance with checking the status of an order. Big Spenders expect that if any assistance is needed with these simple tasks, a simple and quick automated interaction would be sufficient to answer any questions.

With more complex concerns, however, they want to get directly to a live agent. For Big Spenders, filing a complaint (53%), resolving a billing inquiry (50%), and seeking technical assistance with the website (44%) are instances where they prefer to interact with a live agent and resolve the issue quickly. They are experienced enough to know that more complex issues require a live person.

BIG SPENDERS EXPECT AGENTS TO HAVE ACCOUNT ACCESS

Big Spenders are more experienced with eCommerce, and so are more likely to recognize excellence in eCommerce customer service. Consequently, they tend to have high expectations for the information and systems the agents can access. For Big Spenders, 83% expect the agent to see a personal order history, compared to just 58% for Small Spenders. 68% of Big Spenders expect the agent to have access to a history of prior contact with customer service, compared to 46% of Small Spenders. And 53% of Big Spenders expect the agent to have access to their personal loyalty program history, compared to 38% for Small Spenders.

Big Spenders present both a challenge and an opportunity for eCommerce retailers. The challenge is that Big Spenders have high expectations for the website experience, prefer interacting with a live agent for complex issues, and assume the agents have access to account information and history. At the same time, the revenue opportunities are sizeable. Big Spenders are four times more likely than Small Spenders to spend $500+ a year with a given retailer, and almost seven times more likely to place 10+ orders a year with the retailer. In addition, Big Spenders are 7% more likely than Small Spenders to remain loyal to the retailer.

Peak season is right around the corner. Retailers would do well to organize ample support operations to capitalize on the opportunities this segment offers during the holiday season.