Radial Research: 3 Takeaways from Radial’s Holiday Shopping Consumer Survey

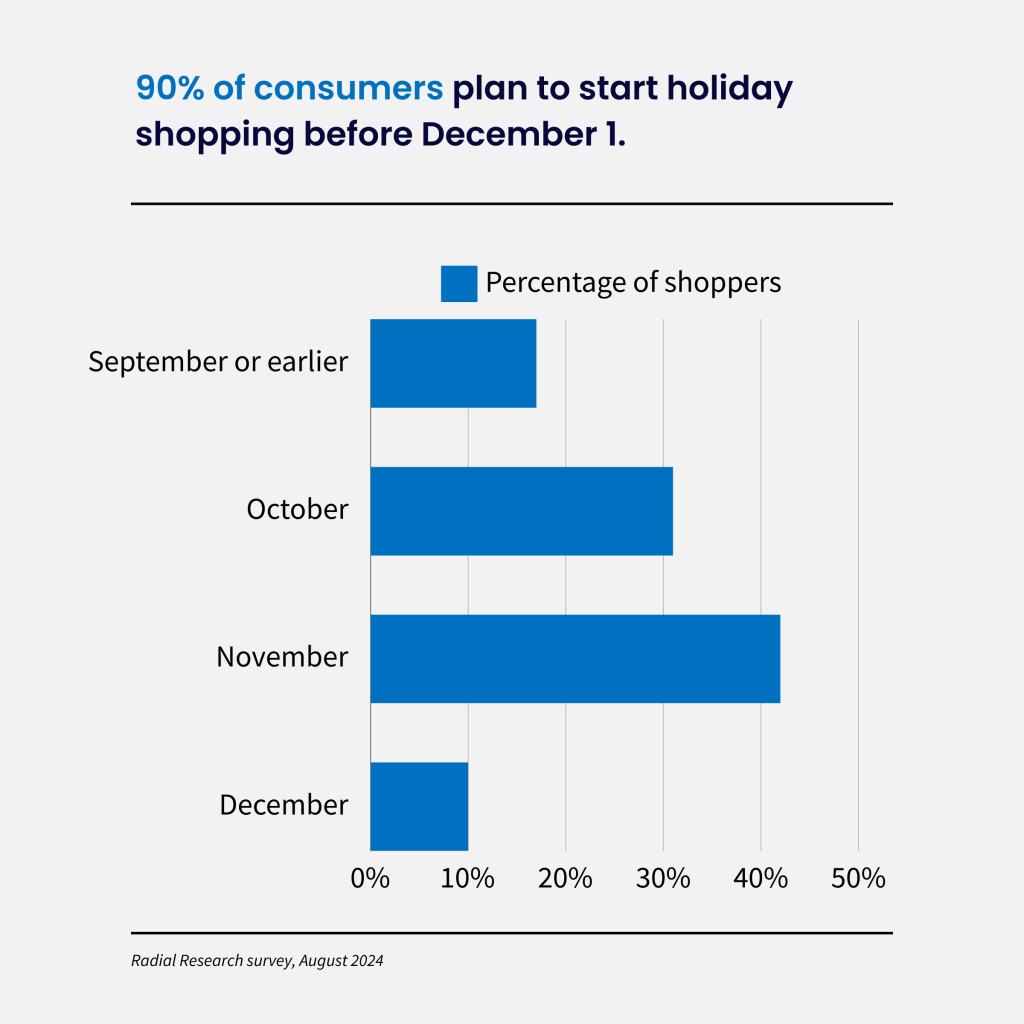

With just 27 days between Thanksgiving and Christmas in 2024, holiday shoppers wasted no time adjusting their timelines. According to Radial’s consumer survey, a staggering 90% of shoppers planned to start before December even began — and nearly a third were already eyeing deals as early as October.

The 2024 holiday season was estimated to see e-commerce sales grow at the fastest rates since 2021, according to EMARKETER. Radial conducted research into key holiday shopping trends.

Here are 3 key takeaways leading brands should consider for any holiday season.

- Retailers prepare for a more aggressive peak season

- Consumers have high expectations for faster delivery times

- Consumers continue to be financially cautious

Retailers Prepared for a More Aggressive Peak Season

There were only 27 days between Thanksgiving and Christmas in 2024, and consumers were adjusting their holiday shopping timelines accordingly. Per Radial’s consumer survey, 90% of respondents were expected to start their holiday shopping before December 1. And 31% of consumers intended to kick off holiday shopping by October to capture savings from events like Amazon’s Prime Day and other early promotions. November was anticipated to continue to generate the most shopping activity, with 42% of consumers planning to launch holiday shopping around major events like Black Friday and Cyber Monday.

Thirty-one percent of consumers intended to kick off holiday shopping by October and 42% planned to shop in November.

The clock was ticking on an aggressive 2024 peak season, with retailers needing to be prepared to meet surges in consumer demand. That meant preparing for greater demand in an even shorter window of time—straining workforces and fulfillment operations.

Consumers Have High Expectations for Faster Delivery Times

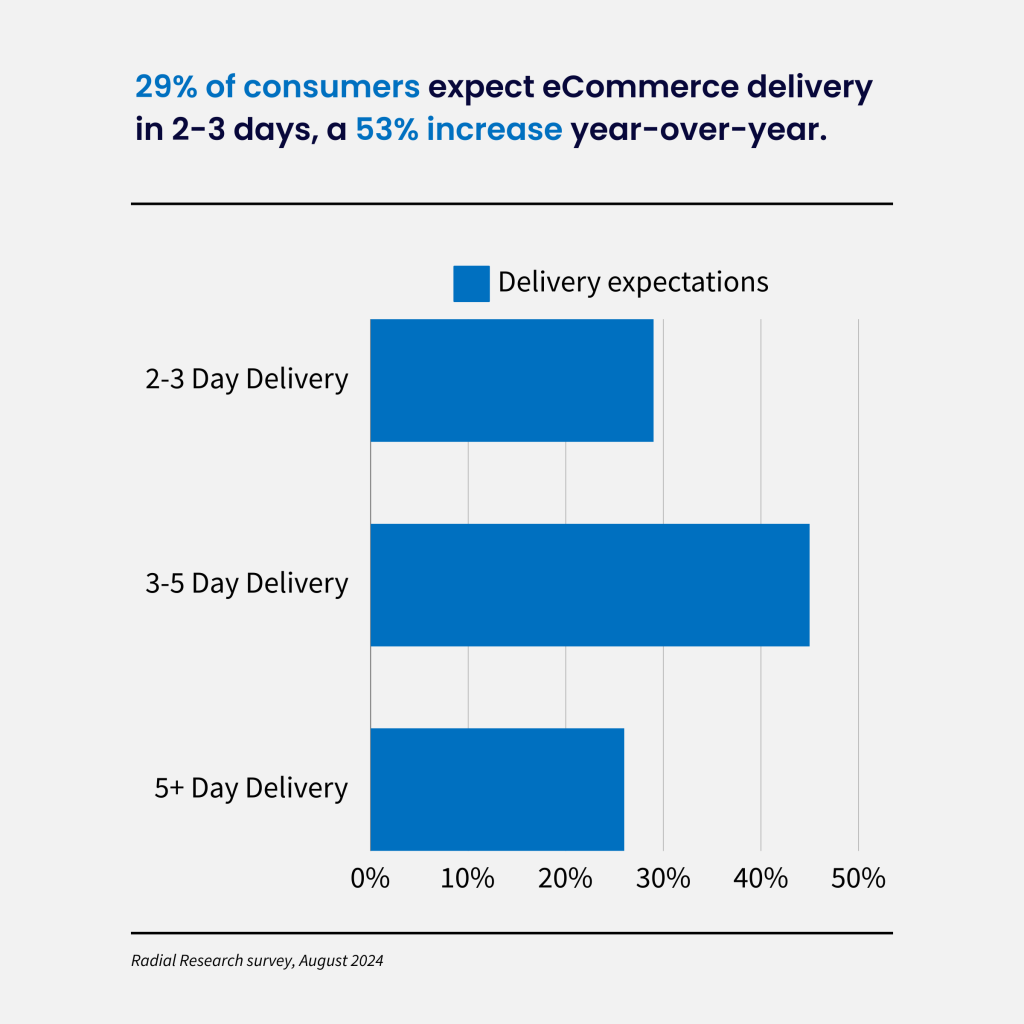

In addition to a shorter peak season, retailers contended with high customer expectations for peak delivery. Radial’s research shows that 29% of shoppers expected their holiday gifts to be delivered within 2-3 days—a 53% increase year-over-year. Forty-five percent of consumers accepted a 3–5-day delivery window, but only 26% of consumers said that waiting a week or more is acceptable.

Twenty-nine percent of consumers expected online orders to arrive in 2-3 days—a 53% increase year-over-year.

Radial’s research also identified that consumers want more control over their delivery experience. More than half of consumers (58%) noted they will likely use a feature to select specific delivery days—if affordable and available. Brands can boost their customers’ experiences by offering varied delivery options to expand both speed and convenience.

Likewise, leading retailers consider their returns process in addition to their delivery promises. Negative return experiences can affect customer loyalty, and brands may need to assess their current returns management processes to ensure simple, convenient returns.

The stakes are high: 73% of consumers claim they will not purchase again from a retailer that provided a poor delivery or returns experience during a holiday season.

Consumers Continue to be Financially Cautious

Consumers approached the holidays influenced by continued economic uncertainty. Thirty-eight percent of consumers reported having a smaller budget for holiday gifts in 2024 versus 27% in 2023. Many shoppers subsequently looked for the best promotions, sales, and deals for the peak season.

Radial’s research also revealed that 18% of shoppers expected to use Buy Now Pay Later (BNPL) or other financing options, with Millennials (27%) being the most likely to do so. Many consumers prefer flexible payment methods to manage holiday expenses without reducing gift-giving—despite economic stressors.

As the holiday season approached, retailers needed to consider offering competitive pricing and attractive promotions to cater to budget-conscious shoppers. Highlighting flexible payment options such as BNPL can also appeal to consumers seeking to manage spending more effectively.

By offering personalized services as low-cost upgrades, retailers can also cater to those who are willing to pay for a more customized shopping experience, without alienating price-sensitive shoppers. For example, 55% of Gen Z and 52% of Millennials would pay for gift wrapping at the right price. This creates an opportunity for brands to reduce holiday stress and enhance the shopping experience for key customers.

Prepare for Peak with the Right 3PL Partner

Radial’s research underscores the importance of a comprehensive click to delivery experience to boost sales and satisfy customers through the holiday season and beyond.

For retailers partnering with Radial, these insights highlight the importance of seamless logistics solutions to delight customers.